General Statistics:

- Total RWA Values (Source)

⚖️ Legal and Regulatory Frameworks

The Hong Kong Financial Services and the Treasury Bureau (FSTB) and the Hong Kong Monetary Authority (HKMA) issued a legislative proposal for stablecoin regulations. This proposal includes licensing requirements for stablecoin issuers and the management of reserve assets. Stablecoin issuers’ assets must be high-quality and liquid, and they must have reserves approved by HKMA. Source

🖇️ Corporate Investments and Strategic Partnerships

Particula acquired the International Token Standardization Association (ITSA) and collaborated with the Digital Token Identifier Foundation (DTIF). This agreement involves transitioning the crypto asset identification process from ITSA’s International Token Identification Number (ITIN) to DTI. Additionally, token reference data based on the ITC framework will be integrated into the DTI Registry. Source

Standard Chartered Bank Hong Kong, Animoca Brands, and Hong Kong Telecom are collaborating to explore stablecoin issuance in the Hong Kong Monetary Authority’s stablecoin sandbox. This project aims to investigate the use of stablecoins for consumer and merchant payments. Standard Chartered’s subsidiary, Zodia Custody, will support this work. Source

Moody’s joined the Monetary Authority of Singapore’s (MAS) Project Guardian initiative. This initiative explores asset tokenization, and Moody’s plans to conduct risk analysis specifically on tokenized fixed income assets. The project includes digital bonds, digital funds, stablecoins, and tokenized deposits. Moody’s states that this initiative will increase transparency in the financial sector and reduce systemic risk. Source

🏠 Asset Tokenization

Diamond Standard Fund Launch by InvestaX. The Diamond Standard Fund, in collaboration with Oasis Pro Inc. and InvestaX, is making diamonds an investable asset class in the Asian market. The fund offers investors access to $1.2 trillion worth of natural diamond resources while providing transparent and secure investment opportunities through the InvestaX platform. Source

RWA.xyz will include tokenized agricultural products and oil metrics.

🪙 Tokenization of Financial Products & Stable Tokens

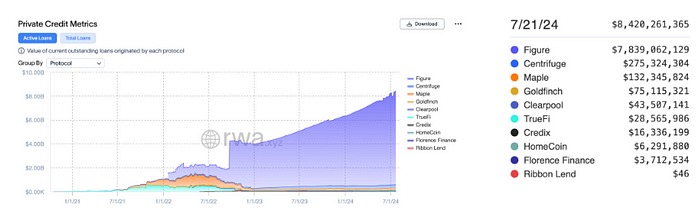

Private Credit (Source)

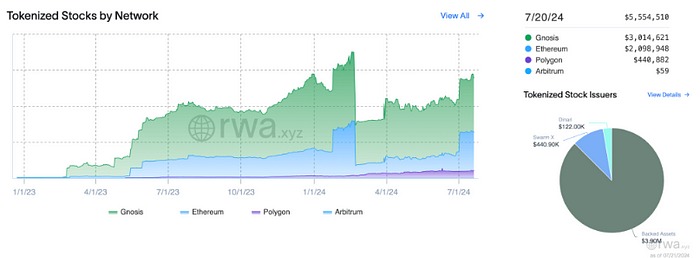

Tokenized Stocks (Source)

InvestaX announced tokenized funds in Asia. These funds provide investors with access to a broader range of assets at lower costs. Tokenization offers significant advantages to investors by increasing liquidity and accelerating investment processes. Source

The market for tokenized US Treasury bills is expected to reach $3 billion by 2024. This growth will be accelerated as investors move towards more liquid and transparent financial instruments. The increased use of digital asset platforms will make this market more accessible. Source

Backed introduced new tokenized stocks including Microsoft (bMSFT), GameStop (bGME), MicroStrategy (bMSTR), Tesla (bTSLA), and Alphabet (bGOOGL). These new products offer the opportunity to invest in S&P 500 companies while allowing investors to hold their assets on-chain and under their own custody. Source

State Street is working on tokenized deposits and stablecoins. The bank plans to conduct risk analysis on fixed income tokenized assets, such as digital bonds, digital funds, and stablecoins. Stablecoins are expected to play a significant role in increasing transparency for financial transactions and asset management. Source

Aktionariat is making a strategic shift back to blockchain-based digital equity solutions. The company will focus on developing technical tools for companies interested in blockchain. With a CEO change, Murat Ögat is the new CEO, and Konstantinos Zavoudakis has been appointed COO. Source

🏦 Central Bank Digital Currencies (CBDC) & Banking

Cboe Clear Europe tested CBDC in margin completion transactions as part of ECB’s DLT trials. The tests included insufficient CBDC, withdrawal transactions, and end-of-day balance operations. This raises the question of whether CBDC will be treated the same as other central bank reserves if ECB introduces wholesale CBDC. Source

Putin Wants to Accelerate Russia’s CBDC Deployment. Vladimir Putin wants to speed up the deployment of Russia’s central bank digital currency (CBDC). Initial digital ruble trials began last year, and second-phase trials will start in September. Putin emphasizes that digital assets and CBDC could be significant in bypassing sanctions. Source

The Bank of Canada published a report titled “Public Money in the Digital Age,” advocating for the necessity of a central bank digital currency (CBDC). The report highlights three main trends threatening the current monetary system: digitalization, the decline in cash usage, and the demand for crypto assets. Additionally, it states that CBDC will play a critical role in preventing systemic risks posed by private sector currencies and foreign CBDCs. Source

💻 Infrastructure and Technology Developments

DeCurret DCP began production tests for the DCJPY tokenized deposit network in Japan and plans to go live in August. The first application involves using tokenized renewable energy certificates (REC) in payment transactions. This platform simultaneously executes asset and money swaps, providing transparency and automation. Source

BNP Paribas and Ant Group are collaborating on tokenized deposits, exploring innovative solutions in global treasury management. Ant’s Whale platform aims to increase the efficiency and transparency of banking payments using blockchain, cryptography, and artificial intelligence. Ant’s SME payment platform WorldFirst will join Europe’s SEPA payment system. Source

The Polygon network has seen significant interest for real-world assets (RWA), rising to the second position after Ethereum. This development is supported by multiple RWA launches, and a notable increase in the MATIC token. Italy’s largest banks issued €25 million worth of digital bonds on Polygon. Source

Plume Network positioned as an L2 for RWA, has gone live with its Testnet. Source

Other Statistics:

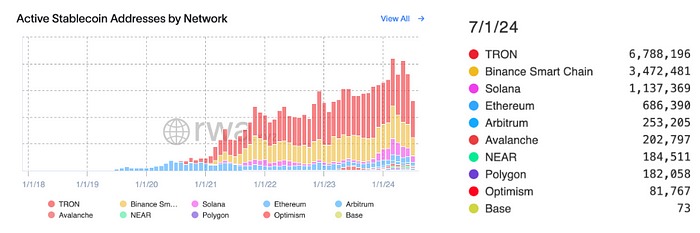

- Stable Token Distribution by Networks — Monthly (Source)

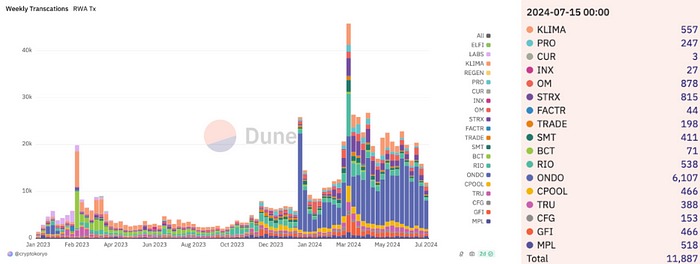

- Weekly RWA Transaction Count (Source)