General Statistics

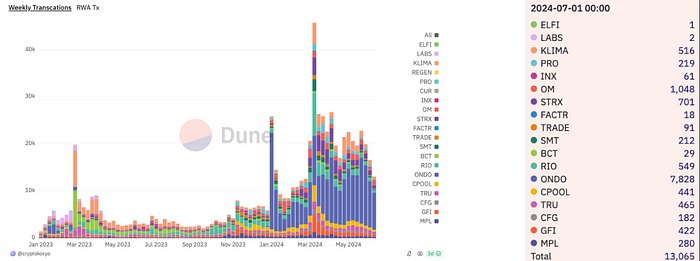

Weekly RWA Transaction Count (Source)

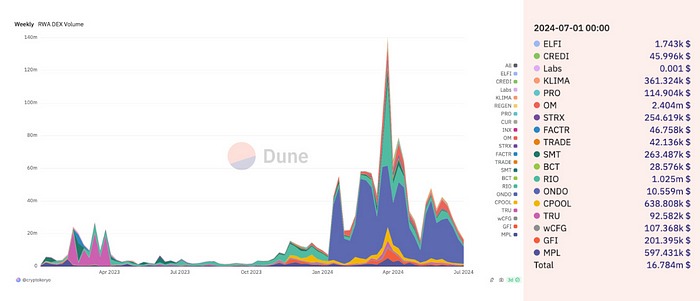

Distribution of RWA Subcategories by DEX Volumes (Source)

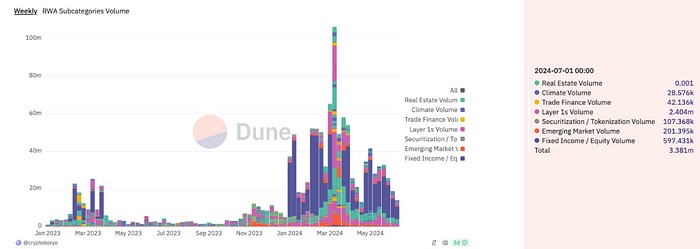

Volume Distribution by RWA Subcategories (Source)

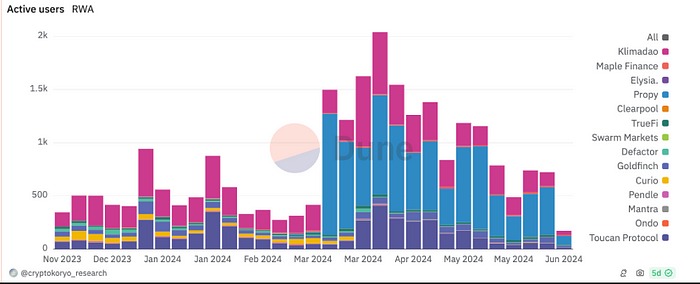

Active RWA User Count (Source)

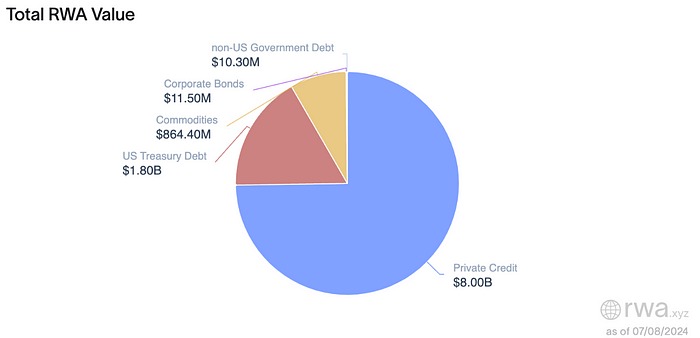

Total RWA Values (Source)

⚖️ Legal and Regulatory Frameworks

Societe Generale’s digital asset unit, Societe Generale Forge, obtained an e-money license from France for its EURCV stablecoin. This license allows EURCV to be used as a legally backed stablecoin, enhancing the security of digital financial products. [Source]

Germany-based DekaBank received a full-scale registration service license for crypto assets. This license enables DekaBank to maintain records of crypto assets, offering broader digital asset services to its customers. [Source]

At Goldman Sachs’ Digital Assets Conference, institutions discussed topics such as the adoption of digital assets, regulatory compliance, tokenization, decentralized finance (DeFi), and stablecoins. Participants debated the impact of digital assets on financial markets and the future of this new asset class. [Source]

🖇️ Institutional Investments and Strategic Partnerships

Sygnum and Fidelity International partnered with Chainlink to move net asset value (NAV) data of funds onto the blockchain. [Source]

Financial services firm Hidden Road is expanding its services by adding new exchanges and accepting the BlackRock BUIDL token as collateral. This step facilitates investors’ access to more diverse trading platforms and allows them to use BlackRock’s digital assets as collateral. [Source]

🏠 Asset Tokenization

Asset Metrics (RWA.xyz)

In the UAE, MAG partnered with MANTRA to tokenize $500 million worth of real estate assets. This tokenization transaction is the first of its kind in the UAE real estate sector, providing greater access and liquidity to investors. [Source]

OroEx Corp pre-approved the tokenization of 1.5 million ounces of gold from Great Eagle Gold Corp’s Cahuilla Gold Deposit. In this process, 1.5 million ounces of gold will be converted into 584,761 NatGold coins, with the company retaining 470,733 of these coins in line with ESG principles. [Source]

T-Blocks is initiating the tokenization process of €235 million worth of real estate and green energy assets. This tokenization initiative aims to enhance liquidity by facilitating digital investments in real estate and green energy assets for investors. [Source]

ELMTNS announced plans to launch a new platform for commodity tokenization. This platform aims to transform commodities into digital assets, offering investors more liquid and accessible investment options. ELMTNS’s initiative will accelerate the digitalization of commodity markets, enabling more transparent and efficient trading. [Source]

🪙 Tokenization of Financial Products & Stable Tokens

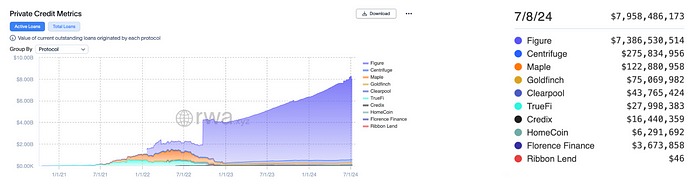

Distribution of Loan Values in Leading Protocols According to RWA.xyz

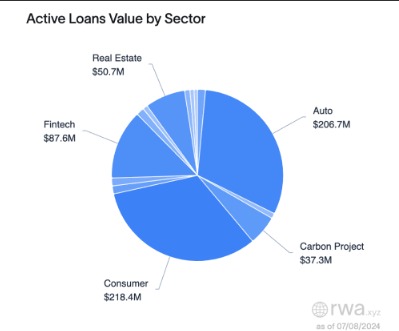

Distribution of Loan Values in Leading Protocols by Sector According to RWA.xyz

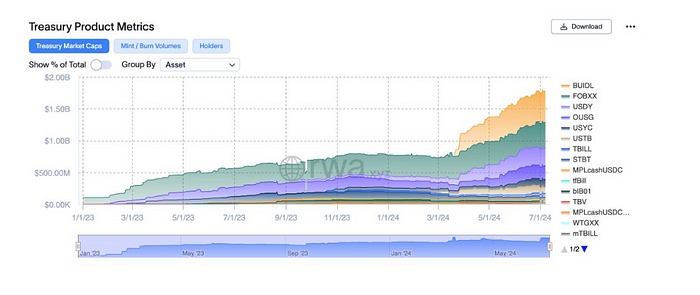

Treasury Product Metrics (RWA.xyz)

Crypto exchange Bitfinex announced the issuance of tokenized bonds on the Liquid Network Bitcoin sidechain. [Source]

Germany’s state-owned KfW issued a €100 million digital bond on the Polygon blockchain. This bond leverages blockchain technology for efficiency, security, and transparency. KfW’s move is seen as a significant development in the adoption of blockchain technology by state-supported financial institutions. [Source]

The Universal Digital Payment Network (UDPN) has introduced new production systems for tokenized deposits, stablecoins, and asset tokenization. This innovation provides financial institutions and businesses with more secure and efficient ways to manage digital assets. [Source]

The INX platform has started trading independently tokenized Nvidia shares. This initiative offers investors the opportunity to invest digitally in Nvidia shares. Tokenized shares provide more flexibility and accessibility for investors, supporting the integration of stock trading into the digital asset ecosystem. [Source]

Schroders Capital and Hannover Re partnered to trial the tokenization of insurance-linked securities (ILS). This trial aims to offer ILS as digital assets to a broader investor base and facilitate their trading. [Source]

💻 Infrastructure and Technology Developments

Digital Asset introduced new interoperability technology for the Canton DLT network, a decentralized financial market ecosystem. This technology enables asset transfer and governance functionality between different DLT (Distributed Ledger Technology) systems. [Source]