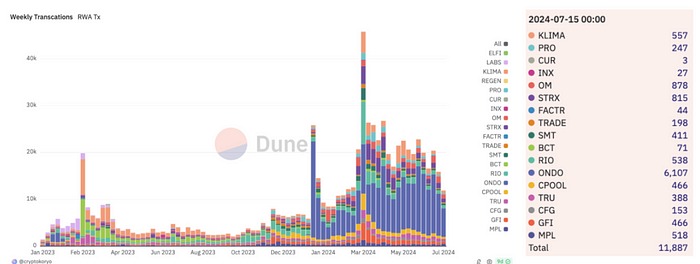

General Statistics:

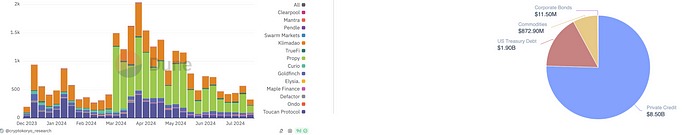

Active RWA Users (Source) & Total RWA Value Distribution (Source)

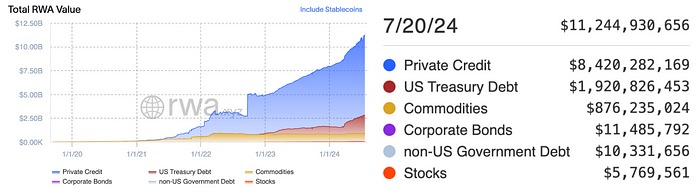

Total RWA Values (Source)

⚖️ Legal and Regulatory Frameworks

Hong Kong plans to introduce a new licensing regime for stablecoins. Licensing criteria include supporting all circulating stablecoins with reserves equal to at least the nominal value, segregating and safeguarding reserve assets, and regular reporting. Source

Luxembourg proposed a new DLT law to improve the issuance and registration of digital securities. This law introduces the role of a control agent to oversee the tracking and quantities of digital securities. Source

🖇️ Corporate Investments and Strategic Partnerships

Citi, JPMorgan, and SIX see great business potential in Blockchain. Citi has launched a pilot of its private blockchain service, Citi Token Services, offering instant payments and 24/7 liquidity management to institutional clients. JPMorgan is trading tokenized assets with its Onyx Digital Assets platform and using the permissioned blockchain network, Quorum. Source

Chainlink has launched the Digital Assets Sandbox (DAS) to accelerate digital asset innovation for financial institutions. DAS allows institutions to test and validate digital asset use cases within days. Source

Ownera, supported by JP Morgan, aims to enhance the distribution and interoperability of tokenized assets through collaboration with Digital Asset’s Canton Network. Assets on the Canton network will be accessible via Ownera’s FinP2P routing network. Source

🏠 Asset Tokenization

DAMREV signed a $330 million deal to tokenize a copper mine in Namibia. This project will convert mining assets into digital tokens, offering investors fractional ownership, increased liquidity, and transparency. Source

Kenedix, in collaboration with SMBC Trust Bank, Nomura Securities, and BOOSTRY, completed Japan’s first real estate security token public offering. Tokens representing 484 rental properties in and around Tokyo were issued, totaling 9.251 billion yen. This initiative is part of Kenedix’s goal to tokenize 2.5 trillion yen worth of real estate by 2030. Source

Mitsui & Co Digital Commodities plans to distribute its tokenized gold product, ZipangCoin, in Korea. This initiative will be carried out in partnership with Creder, a joint venture of Korean blockchain firms BMPG and ITcen. Source

The new tokenization platform Libre, backed by Brevan Howard and Hamilton Lane, has launched in collaboration with Nomura’s Laser Digital unit and Alan Howard’s WebN Group. Libre is built on Polygon. Source

Italy’s state bank Cassa Depositi e Prestiti SpA issued digital bonds worth 25 million euros ($27.2 million) on the Polygon blockchain network. Source

🪙 Tokenization of Financial Products & Stable Tokens

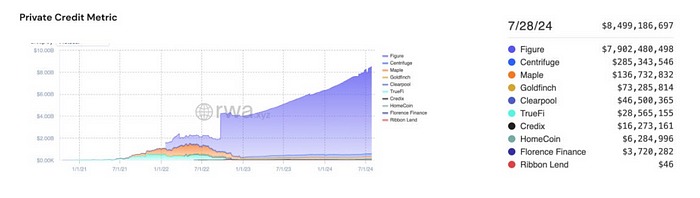

Private Credit (Source)

Tokenized Shares (Source)

OpenEden tokenized U.S. Treasury Bonds, reaching a value of $75 million. The platform offers investors tokenized returns on U.S. Treasury Bonds. Source

Arca Labs opened the secondary market trading of its ’40 Act fund, regulated by the SEC and tokenized on the blockchain. Arca’s Treasury Fund will be tradable on the Securitize Markets platform and holds assets worth approximately $405,000. Source

🏦 Central Bank Digital Currencies (CBDC) & Banking

Bangko Sentral ng Pilipinas (BSP) plans to launch a wholesale central bank digital currency (wCBDC) by 2029. Source

Bank of Israel selected 14 participants for its Digital Shekel Challenge. Participants include major names like Fireblocks, PayPal (Israel), and IDEMIA. Source

None of the nine approved ETH ETFs have bank custodians. Of the nine Ethereum ETFs approved by the U.S. SEC, eight are held by Coinbase Custody, and one by Fidelity Digital Assets. Source

The Central Bank of Peru (BCRP) awarded a contract to the telecom firm Viettel Peru to launch its first retail CBDC pilot project. The IMF supports Peru’s CBDC research and has made several recommendations for the project’s success. Source

💻 Infrastructure and Technological Developments

DZ Bank, Commerzbank, Deutsche Bank, and other participants shared the trial results of the Commercial Bank Money Token (CBMT) project. Tokens were created and used on networks compatible with R3’s Corda, Hyperledger Besu, and Ethereum. Source

The Hong Kong Financial Services and the Treasury Bureau (FSTB) and the Hong Kong Monetary Authority (HKMA) published a legislative proposal for stablecoin regulations. This proposal includes licensing requirements for stablecoin issuers and the management of reserve assets. Stablecoin issuers’ assets must be of high quality and liquid, with reserves approved by HKMA. Source

Other Statistics:

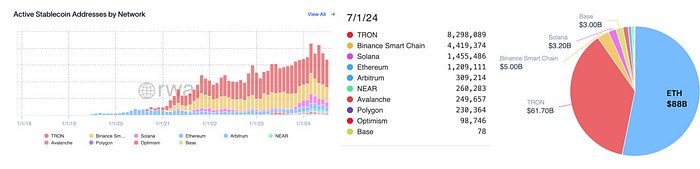

Stable Token Distribution by Networks — Monthly (Source)

Weekly RWA Transactions (Source July 15 data)