General Statistics:

Active RWA Users (Source) & Total RWA Value Distribution (Source)

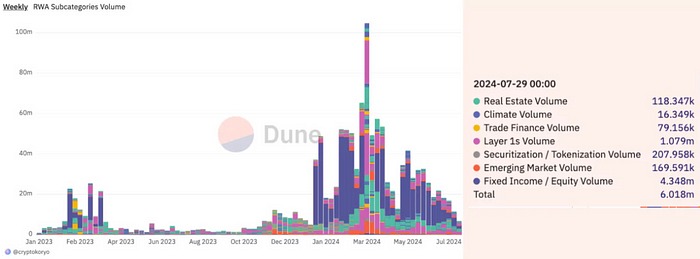

Categorical Distribution of Weekly RWA Volume (Source) — July 29 Data

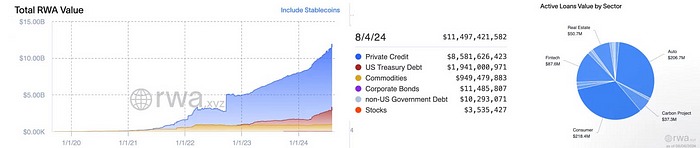

Total RWA Values (Source) and Active Debt Distribution by Sectors (Source)

⚖️ Legal and Regulatory Frameworks

Circle has launched USDC and EURC stablecoins under Europe’s new MiCA (Markets in Crypto Assets) regulations. With this move, Circle became the first global issuer to receive approval for such stablecoins in Europe, offering USDC and EURC to European customers from July 1, 2024. Source

Societe Generale’s blockchain subsidiary, Societe Generale Forge, received an e-money license from France’s financial regulator ACPR for its EURCV stablecoin. This license allows EURCV to be used as a legal payment instrument in the European market, facilitating the expansion of digital financial products. Source

The Association for Financial Markets in Europe (AFME) published a comprehensive action plan to accelerate the adoption of tokenization in Europe. The plan suggests clarifying regulatory frameworks, developing technology infrastructure, and increasing collaboration among industry stakeholders to make financial markets more efficient, transparent, and accessible. Source

🏠 Asset Tokenization

Tokens Based on Precious Metals and Distribution (Source)

Leading real estate developer in the UAE, MAG, partnered with MANTRA to tokenize $500 million worth of real estate assets. Source

Blockchain-based real estate platform Blocksquare partnered with Pieme to tokenize hotel investments. This new initiative aims to make real estate investments more liquid and accessible by allowing investors to invest in hotel properties through digital tokens. The tokenization process provides investors with broader investment opportunities in the real estate market while increasing transaction transparency and security. Source

Indonesia’s first real estate asset tokenization project was launched in collaboration with D3 Labs, Bank Tabungan Negara (BTN), and Reliance Group. This initiative aims to increase the liquidity in the sector by making real estate assets accessible to a wider range of investors through digital tokens. Source

🖇️ Corporate Investments and Strategic Partnerships

Franklin Templeton and Japan’s leading financial services firm, SBI Holdings, announced a joint venture to develop innovative solutions in the digital asset space. Source

Crypto custody firm Anchorage, in partnership with Cumberland-backed Hashnote, will offer investors various investment return opportunities. Source

Standard Chartered and Animoca Brands are among the five companies participating in the Hong Kong Monetary Authority’s (HKMA) stablecoin sandbox program. The sandbox provides participants with opportunities to innovate and conduct experiments on stablecoin adoption and regulation. Source

Libre, backed by Nomura 🇯🇵 and Brevan Howard 🇬🇧, launched operations. Japan-based Libre offers tokenization services on the Solana network to digitalize financial assets and reach a wider investor audience. Source

BlackRock’s $500 million tokenized fund targets Ethena’s RWA investment plan. Source

Backed and Lisk formed a strategic partnership to promote the adoption of real-world assets (RWA) on blockchain in emerging markets. Source

JP Morgan-backed tokenization platform Ownera, in collaboration with Digital Asset, is joining the Canton Network. Canton Network is a secure and private blockchain network designed for institutional-level digital asset transactions. Source

🪙 Tokenization of Financial Products & Stable Tokens

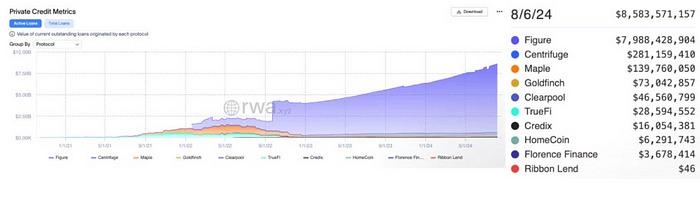

Private Credit (Source)

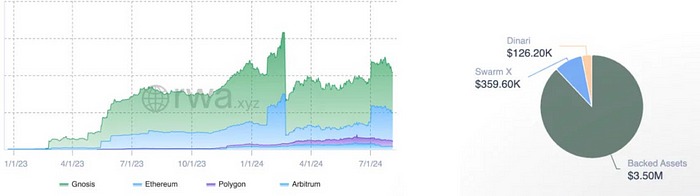

Distribution of Tokenized Shares by Networks (Source)

Bitfinex Securities is introducing tokenized bonds on the Liquid Network, a sidechain of Bitcoin, offering a new financial product to the digital asset ecosystem. These bonds allow institutional investors to raise and invest capital more efficiently. Source

Italy’s largest banks issued digital bonds worth 25 million euros on the Polygon blockchain as part of the European Central Bank’s (ECB) digital bond trial. Source

Ondo Finance launched its stablecoin, USDY, on the Noble platform within the Cosmos ecosystem to provide high-quality yields. USDY aims to increase liquidity in the Cosmos network and offers users a wider range of DeFi applications. Source

Coinbase Asset Management plans to launch a tokenized money market fund inspired by the success of BlackRock’s BUIDL fund. Source

Ripple allocated a $10 million fund to support innovations in tokenized U.S. Treasury bonds on the XRP Ledger. Source

Singapore-based investment platform Bake partnered with OpenEden to offer users the opportunity to invest in tokenized U.S. Treasury bonds. Source

🏦 Central Bank Digital Currencies (CBDC) & Banking

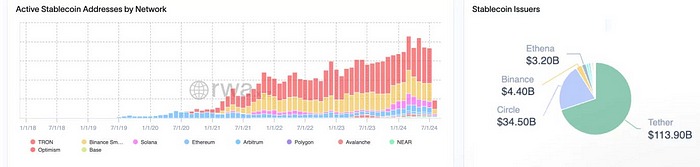

Distribution of Active Stable Coins by Networks and Companies Issuing Stable Coins (Source)

Superstate launched a Crypto Carry Fund with USCC. Source

Slovenia issued the Eurozone’s first sovereign digital bond, successfully launching a 100 million euro bond. This bond issuance was organized by BNP Paribas. Source

Italy’s national development bank, CDP, issued a digital bond on the Polygon blockchain using new Italian law. Source

The Bank of England (BoE) highlighted tokenization as a significant innovation initiative to support the modernization of the financial system. The bank emphasized tokenization’s potential to increase efficiency and transparency in the financial services sector. This initiative aims to strengthen the UK’s position as a global financial center through the adoption of digital assets and blockchain technology. Source

Bank Indonesia (BI) is preparing to enter the second phase of wholesale central bank digital currency (CBDC) trials. This phase will focus on evaluating the impact of CBDC on interbank payments and financial markets. Based on findings from the first phase, the second phase will explore how CBDC can be integrated securely and efficiently and examine its potential impacts on digital payment systems. Source

The Bank of England and the Bank for International Settlements (BIS) announced the development of a new tool to monitor stablecoin reserves. Source

The European Central Bank (ECB) is seeking expert opinions on enabling the offline use of the digital euro. This initiative aims to increase the digital euro’s usability in offline transactions, allowing users to make digital payments without an internet connection. The ECB anticipates that developing this feature will enhance the adoption of the digital euro and improve user experience. Source

💻 Infrastructure and Technological Developments

Archax uses Quantoz EURd electronic money token to make abrdn’s money market fund accessible and transferable on the Algorand blockchain. Source

Digital Asset firm announced Canton Coin, a new interoperability technology for the Canton DLT network, and a governance layer. This technology enables secure and efficient transfers of digital assets and data between different applications, improving the integration of decentralized financial ecosystems. Financial institutions joining the network will access broader collaboration and interoperability opportunities with these new features. Source

Injective, in partnership with Mountain Protocol, became the first blockchain to offer USDM as collateral for derivatives. Source

The California DMV transferred 42 million vehicle registrations to the Avalanche Blockchain to combat fraud. This initiative aims to ensure the accuracy and immutability of vehicle registrations while reducing document fraud. Source

Other

Swiss digital asset bank Sygnum, led by Fatmire Bekiri, offers the CryptoPunks collection to its clients. Source