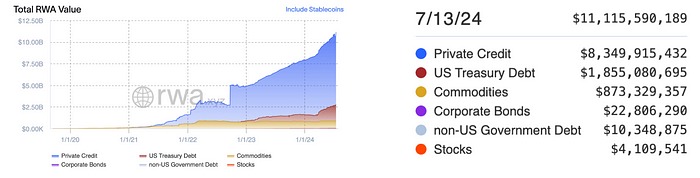

General Statistics: Active RWA User (Source) & Total RWA Value Distribution (Source)

Total RWA Values (Source)

⚖️ Legal and Regulatory Frameworks

The U.S. House of Representatives moved to override a veto of a bill that targets regulations preventing banks from offering crypto asset custody services. This initiative is made with the goal of increasing the wider adoption of crypto assets and enhancing banks’ capabilities to offer crypto services. Source

The U.S. House of Representatives Failed to Remove Crypto Custody Blockade, but SEC Considers Changes. The U.S. House of Representatives did not achieve a sufficient majority to remove the SEC’s SAB 121 accounting rule that prevents banks from digital asset custody. However, it has been reported that the SEC is considering changes that would allow banks to offer crypto custody services. These changes might include only reporting crypto assets in notes or narrowing their definition. Source

SEC to Make Changes in Crypto Custody Blockade. Representative Maxine Waters stated that the SEC will change the SAB 121 rule that prevents banks from digital asset custody. The proposed changes will enable banks to offer digital asset custody services while ensuring regulatory compliance. This development could allow a broader scope of crypto assets to be maintained by banks. Source

🖇️ Institutional Investments and Strategic Partnerships

Fasset and Dinari collaborated to list Dinari’s tokens, representing U.S. stocks and ETFs, on Fasset’s digital asset exchange. This partnership provides global investors with access to leading stocks like Apple, Nvidia, Tesla. Dinari’s real-world asset-based tokens and Fasset’s secure exchange facilitate portfolio diversification for a wider audience. Source

Schroders Capital and Hannover Re from Tokenization Trial. Schroders Capital and Hannover Re conducted a trial on a public blockchain to tokenize reinsurance contracts. Source

Hidden Road Accepts BlackRock’s BUIDL Token as Collateral. Hidden Road added new integrations with Coinbase, OKX, Deribit, and other major exchanges to its platform. The company accepts BlackRock’s BUIDL token as collateral, providing flexibility in digital asset trading. This innovation allows investors to achieve up to 5% risk-free returns using the BUIDL token as collateral. Source

Global Digital Finance (GDF) and FIX Trading Community formed a working group for tokenization compatibility. This collaboration aims to facilitate investors’ easy access to digital assets using the FinP2P protocol to ensure compatibility across different blockchain networks. The FIX protocol will enable trading of traditional and digital securities through a single interface. Source

DBS, JP Morgan, and Mizuho are testing a blockchain-based foreign exchange settlement (PvP) solution on the Partior platform. This solution aims to reduce counterparty risks in foreign exchange transactions, making transactions safer and more efficient. The tested system uses blockchain technology to reduce transaction times and improve liquidity management. Source

🏠 Asset Tokenization

Heart and Tiamonds AG from Strategic Partnership for Diamond Tokenization. Heart Ecosystem and Tiamonds AG formed a strategic partnership to tokenize real-world diamonds and list them on the STOEX (SMART Token Exchange) platform. This collaboration aims to increase transparency and liquidity in the diamond market by offering investors 1:1 or fractional ownership of high-value diamonds. Heart Ecosystem supports the digitalization of diamond investments by providing a regulatory-compliant and secure trading environment. Source

Phillip Securities announces the issuance of security tokens for Sony’s “Hero Island” movie. Supported by Securitize Japan’s technology, these tokens will allow investors to share in the film’s revenues and win various valuable rewards. The tokens, worth ¥100,000 ($629), will be issued on a permissioned blockchain and will be launched next week. Source

🪙 Tokenization of Financial Products & Stable Tokens

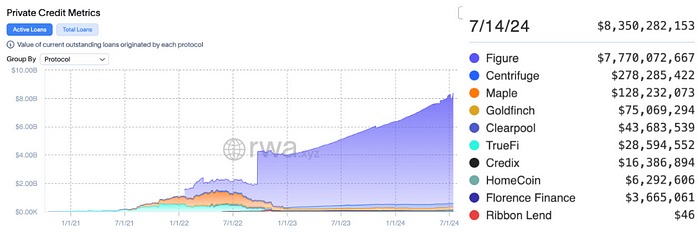

Private Credit (Source)

Tokenized Stocks (Source)

Hamilton Lane, AltaX, and Phillip Securities from Sharia-Compliant Private Credit Tokenization. Hamilton Lane, AltaX, and Phillip Securities are listing Hamilton Lane’s SCOPE fund as tokenized under the Monetary Authority of Singapore’s (MAS) Project Guardian. The partnership aims to introduce the world’s first Sharia-compliant tokenized private credit fund to the global Islamic fund market. Source

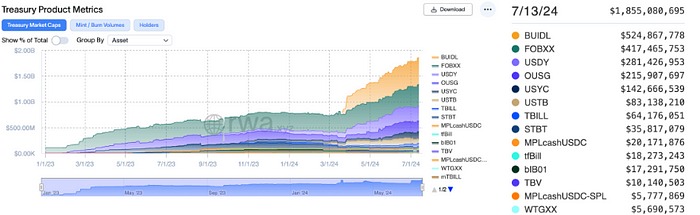

BlackRock’s BUIDL token is poised to exceed a market value of $500 million. Source

Goldman Sachs plans to launch three new tokenization projects by the end of 2024. These projects, particularly focused on the U.S. and European markets, will target institutional clients and use private blockchain networks to enhance compliance and improve transaction speeds. The first project will be aimed at the U.S. fund market. Source

ABN AMRO prefers public blockchain for bond tokenization. The bank has conducted digital bond issuances on public networks such as Ethereum, Stellar, and Polygon. This method offers automation, fast and atomic swaps, and reduced settlement processes. ABN AMRO advocates for the benefits of the shared infrastructure provided by public blockchains, asserting that traditional risks can be managed similarly. Source

Numun Ecosystem advances the tokenization of valuable assets with the launch of Numun.fi application. This app offers investors high returns through emerging market currencies and bonds. The first nStable token will be pegged to the Argentine Peso (nARS), followed by the Brazilian Real (nBRL) and the Mexican Peso (nMXN). Source

Hamilton Lane Tokenizes Credit Funds Under Project Guardian. The private equity giant, Hamilton Lane, is tokenizing credit funds under the Monetary Authority of Singapore’s (MAS) Project Guardian initiative. This initiative aims to enhance the liquidity of funds and expand accessibility for investors using blockchain technology. Source

DekaBank Receives BaFin License for Crypto Securities and Reaches 100th Issuance Milestone. DekaBank has received a license from Germany’s financial regulator BaFin to issue and manage digital securities. With this step, the bank has reached an important milestone by hitting its 100th issuance in the crypto securities field. Source

Singapore-based DBS Digital Exchange reports a rapid increase in digital asset transaction volumes. In the first half of 2024, the volume of digital assets was more than double that of the same period in 2023, showing significant growth. The exchange notes that the increased interest in digital assets from both institutional and individual investors has played a crucial role in this surge. Source

Visa and Banks from Tokenized Deposit Trial. Visa collaborated with HSBC and Hang Seng Bank to conduct a tokenized deposit trial within the Hong Kong e-HKD Pilot program. In the trial, tokenized deposits were used for high-value real estate transactions and Visa card payments. Source

🏦 Central Bank Digital Currencies (CBDC) & Banking

The Central Bank of Taiwan announced the start of trials for a wholesale central bank digital currency (CBDC). The bank aims to gain experience in wholesale use cases before rushing into retail CBDC. These trials will test the feasibility of wholesale CBDC in areas such as interbank payments and large-scale financial transactions. Source

💻 Infrastructure and Technology Developments

European Commission Accepts Apple’s NFC Commitments. The European Commission decided that Apple’s restriction of NFC functionality access to Apple Pay was anti-competitive. Apple agreed to open NFC access to certain developers for free and to allow another wallet app to be set as the default payment app. These commitments will be legally binding for 10 years. Additionally, NFC access will also be provided in Host Card Emulation (HCE) mode. Source

Riksbank’s DLT-Based Retail CBDC Could Have Similar Energy Consumption to Card Payments. The Swedish Central Bank (Riksbank) found that the energy consumption of its distributed ledger technology (DLT)-based retail central bank digital currency (CBDC) could be similar to that of card payments. This research is seen as an important step in assessing the efficiency and sustainability of DLT and will guide the bank in further detailed analysis of CBDC’s potential while considering energy consumption and environmental impacts. Source

💬 Other

Arbitrum STEP Committee Proposes Distributing 35 Million ARB to Six Selected RWA Tokenization Providers. The selected providers include Securitize BUIDL, Ondo USDY, and Superstate USTB. The committee considered current asset management (AUM) and risk factors in its selection criteria. Additionally, more RWA growth is targeted in the future, with distributions planned to start in September-October 2024 following KYC checks. Source

MakerDAO Launches $1 Billion Tokenization Contest to Accelerate Integration of Tokenized Assets (RWA) into the DeFi Ecosystem. This contest aims to encourage various projects to join the Maker protocol, supporting innovative solutions in the DeFi space. The winners will make significant contributions to the MakerDAO ecosystem, enabling tokenized assets to reach a broader audience. Source

Honda, Mazda, and Nissan Complete First Phase of Global Battery Passport Project. The project involves exchanging battery identity and data using W3C decentralized identifiers (DID). This system is used to track the production and recycling processes of batteries. In the second phase, the Citopia web3 marketplace will be tested, supporting applications such as battery and carbon credit management. Source

Other Statistics: Stable Token Distribution by Networks — Monthly (Source)