General Statistics:

Data as of August 20 (Source)

🌍 Total on RWA Chain: $11.50B (+3.28% compared to 30 days ago)

🧑🤝🧑 Total Asset Holders: 61,740 (-4.66% compared to 30 days ago)

🏢 Total Asset Issuers: 100

💲 Total Stablecoin Value: $167.71B (+102.49% compared to 30 days ago)

👥 Total Stablecoin Owner Accounts: 116.07M (-4.66% compared to 30 days ago)

Total RWA Market Value (Source) & RWA Product Volume Distribution (Source) August 10

⚖️ Legal and Regulatory Frameworks

🇦🇪 Dubai Court Validates Salary Payments in Cryptocurrency

In a landmark decision, a Dubai court recognized salary payments in cryptocurrency. The court accepted the claim of an employee who agreed to receive part of their salary in cryptocurrency but did not receive payment, ruling that salary payments in cryptocurrency are valid. This decision paves the way for companies to pay contractual employees in cryptocurrency. Last year, a similar request was denied by the same court, but this year the plaintiff succeeded by presenting evidence.

🇷🇺 New Laws on Crypto Asset Usage in Russia and Key Points for Banks

Russia has enacted significant legislative regulations regarding the use of crypto assets. The regulation, passed by the Duma on July 30, 2024, and effective August 18, 2024, permits crypto mining and the use of cryptocurrencies by businesses in international trade. This regulation offers Russia a significant opportunity to circumvent Western economic sanctions. Additionally, the Russian Central Bank has been granted permission to make international money transfers using cryptocurrencies. Digital ruble initiatives are also expected to start soon. Source.

🏠 Asset Tokenization

MANTRA and Novus Capital to Tokenize Aviation Assets!

MANTRA, a layer-1 (L1) blockchain focusing on RWAs, is partnering with Novus Aviation Capital to tokenize aviation assets. This collaboration aims to make asset ownership more accessible in the $200 billion aviation finance market and simplify the financing process. By offering fractional ownership through tokenization, they plan to increase liquidity, reduce risks, and open these assets to a broader investor base. Source

Nigeria State Plans to Increase Revenue by Tokenizing Real Estate

Lagos State in Nigeria has launched a project to increase state revenue by tokenizing real estate assets. The project aims to address issues like land fraud while providing a safer and more efficient system for property ownership. The Lagos government has allocated a budget of 500 million naira (approximately $314,465) to support this initiative, which is set to be implemented over 16 months. Source.

🪙 Tokenization of Financial Products & Stable Tokens

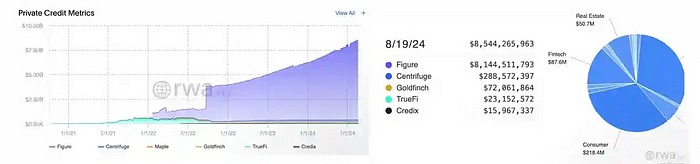

Private Credit (Source)

Distribution of Tokenized Stocks Across Networks (Source)

Hamilton Lane Tokenizes a $5.6 Billion Secondary Fund

Hamilton Lane has provided access to qualified investors by tokenizing part of its $5.6 billion Secondary Investment Fund VI. Offered through the Securitize platform, this tokenized fund allows investors to participate with lower minimum investments. Exceeding its original target of $5 billion, the fund has now raised $5.6 billion and is available on the Polygon blockchain. Source

Head of Fidelity Digital Asset Management: Stablecoins, Tokenized Treasury Bonds, and On-Chain Credit Solutions in Focus

Cynthia Lo Bessette, Head of Fidelity Digital Asset Management, stated that stablecoins, tokenized treasury bonds, and on-chain credit solutions are key areas in the company’s digital asset management strategy. Lo Bessette mentioned that blockchain enables activities that are not possible in current capital markets and that stablecoins provide value as tokenized cash. She added that tokenized treasury bonds and credit solutions could be the next step in the evolution of investment products. Source

DBS Bank Launches Blockchain-Based Treasury Token Pilot Program

DBS Bank, in partnership with digital payment provider Ant International, has launched a blockchain-based treasury and liquidity management solution. Announced on August 13, this pilot program includes the use of tokens called DBS Treasury Tokens, which enable instant liquidity management in multiple currencies.

MUFG Morgan Stanley Securities Plans to Issue Digital Securities This Year

MUFG Morgan Stanley Securities (MUFG MSS), a subsidiary of MUFG in Japan, plans to issue digital securities this year. In Japan’s digital securities market, real estate-backed security tokens account for 80% of the market. MUFG MSS focuses particularly on digital bonds and plans to sell these digital bonds to foreign investors through Morgan Stanley’s global network in the future. Additionally, MUFG owns 49% of Progmat, one of Japan’s two major licensed blockchain networks. Progmat is a primary platform for digital securities issuance in Japan, with other investors including major financial institutions like SMBC, Mizuho Bank, and JPX.

🖇️ Corporate Investments and Strategic Partnerships

Tokenized Asset Issuer Backed to Issue Crypto-Backed Real Assets in Latin America with eNor Securities

eNor Securities will offer Backed’s ERC-20 compliant bTokens on its platform, providing retail investors in Latin America access to these tokens. Backed has previously released tokenized versions of individual stocks like Coinbase (COIN) and Tesla (TSLA).

GreenX Signs MOU for Strategic Partnership with Singapore’s InvestaX Platform

GreenX has signed a Memorandum of Understanding (MOU) with InvestaX, a leading security token investment and trading platform in Singapore. This partnership aims to offer opportunities for security tokens and other digital assets to be traded on secondary markets. The collaboration seeks to provide broader access to investors in different regions for token issuers. Furthermore, with the participation of IX Swap, this partnership aims to bridge the gap between centralized finance (CeFi) and decentralized finance (DeFi), enhancing liquidity and market access opportunities. Source

🏦 Public & Central Bank Digital Currencies (CBDC) & Banking

Germany’s State Bank KfW Prepares for Tokenized Bond Issuance with Boerse Stuttgart Digital

Germany’s largest development bank, KfW, is collaborating with Boerse Stuttgart Digital (BSD) to prepare for blockchain-based digital bond issuance. KfW plans to issue this bond under Germany’s Electronic Securities Act (eWpG) in the coming weeks. BSD will manage crypto wallets and secure private keys in this process. This step is part of the European Central Bank’s trials to settle blockchain-based transactions with central bank money.

Reserve Bank of India Explores the Impact of Tokenized Deposits and CBDCs on Deposit Insurance

MD Patra, Deputy Governor of the Reserve Bank of India (RBI), discussed the potential impact of tokenized deposits and central bank digital currencies (CBDCs) on deposit insurance. Tokenized deposits, which are digital versions of banking deposits using blockchain infrastructure, enable programmable payments 24/7. However, this technology could be critical for banks during periods of financial stress due to its ability to facilitate rapid transfers. Source.

💻 Infrastructure and Technological Developments

New Use Cases for Crypto with NFC

Apple’s decision to open up the NFC chip on iPhones to third-party developers presents a significant opportunity for crypto payments and Web3 applications. This move could enable crypto wallets to integrate with NFC technology to facilitate transactions like in-store payments. Considering Apple Pay’s 640 million active users, this innovation could make crypto payments a mainstream payment method. Additionally, it could support the development of scenarios for Web3 applications such as rewards programs, NFT-based ticketing, and inter-device information sharing, enabling greater integration of blockchain technology into daily life.

Mastercard and MetaMask Collaboration Simplifies Crypto Spending

Mastercard, MetaMask, and Baanx have launched a pilot project to facilitate retail spending for crypto holders. Through this project, MetaMask users who keep their cryptocurrencies in their own wallets can spend them via a digital bank card. The crypto will be automatically converted into Euros or Pounds at the time of payment. However, the card only supports USDC, USDT, and WETH tokens held on the Linea blockchain (an Ethereum Layer-2 solution developed by the team behind MetaMask). This limitation requires users to transfer their tokens to the Linea blockchain. The pilot project is currently limited to a few thousand users in Europe and the United Kingdom.

Sling Raises $15 Million to Make Stablecoin Transfers More User-Friendly

Sling has developed a mobile application that simplifies stablecoin transfers, offering fast and low-cost transfers to 50 countries. Operating on the Solana blockchain, Sling uses the Paxos Dollar (USDP) stablecoin to facilitate quick transfers between sender and receiver. Sling provides an easy experience by hiding complex blockchain details from users. The company completed a $15 million Series A funding round led by Union Square Ventures, Ribbit Capital, and Slow Ventures. Users can transfer to people who don’t have the Sling app by sending a link, and recipients can provide their banking information to receive payments converted into fiat. The company plans to add more stablecoins and different currencies in the future.

Other

Tokenization of Football Players!

Defimec Blockchain Technologies announced Sportimex, a new platform that explores Web3 opportunities in the sports world. This platform enables football clubs to generate revenue from young players and distribute financial risks associated with this process. Players’ contractual market values are tokenized, providing Web3 users with investment opportunities. Sportimex aims to solve financial problems related to financial fair play rules and declining revenues faced by clubs. The assets of football players in the Turkish Super League are valued at approximately 1.1 billion euros.

MakerDAO Calls for Proposals for Tokenized Money Market Fund Management for Spark Protocol

MakerDAO is seeking asset managers for Spark Protocol’s tokenized money market fund based on short-term US Treasury bonds.

Polygon Executive: Tokenized Real-World Assets (RWA) Offer a $30 Trillion Opportunity

Colin Butler, Vice President of Polygon, stated that tokenized real-world assets (RWA) present a $30 trillion opportunity in the financial world. Butler emphasized that tokenization offers new investment opportunities by digitizing physical assets such as commodities, real estate, art, and government bonds on the blockchain. With the growth of DeFi and decentralized finance ecosystems, this asset class is expected to play a significant role in the financial system. Polygon positions itself as a key infrastructure provider in this space.

Statistics:

Source: rwa.xyz. August 20, 2024

Note: Distinguishing between unique users and unique accounts may be ambiguous. As many users have multiple wallets, the management of these wallets on exchanges may differ from expected.

Stablecoins

- Market Value: $167.71 billion

- Percentage of M2 Money Supply: 0.8%

- Monthly Transfer Volume: $1.66 trillion (7.74% increase compared to 30 days ago)

- Monthly Active Addresses: 17.51 million (11.91% decrease compared to 30 days ago)

- Unique Addresses: 116 million (4.66% decrease compared to 30 days ago)

Tokenized Treasury Bonds

- Total Value: $1.91 billion

- Average Yield to Maturity: 4.95%

- Weighted Average Maturity: 0.111 years

- Owners: 5,559

Tokenized Private Credit

- Value of Active Loans: $8.82 billion

- Total Loan Value: $14.05 billion

- Current Average Annual Percentage Rate (APR): 9.02%

- Total Loans: 1,876

Tokenized Commodities

- Market Value: $961.99 million

- Monthly Transfer Volume: $156.18 million (7.39% decrease compared to 30 days ago)

- Monthly Active Addresses: 2,157 (82.8% decrease compared to 30 days ago)

- Owners: 56.18k

Tokenized Shares

- Total Value: $5.49 million (10.18% decrease compared to 30 days ago)

- Monthly Transfer Volume: $1.33 million (108.34% increase compared to 30 days ago)

- Monthly Active Addresses: 105 (15.24% decrease compared to 30 days ago)

- Owners: 719 (3.48% decrease compared to 30 days ago)