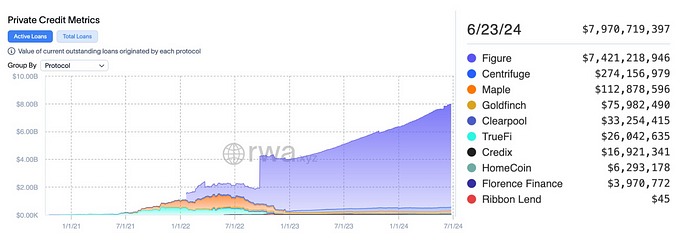

Distribution of Loan Values in Leading Protocols According to RWA.xyz

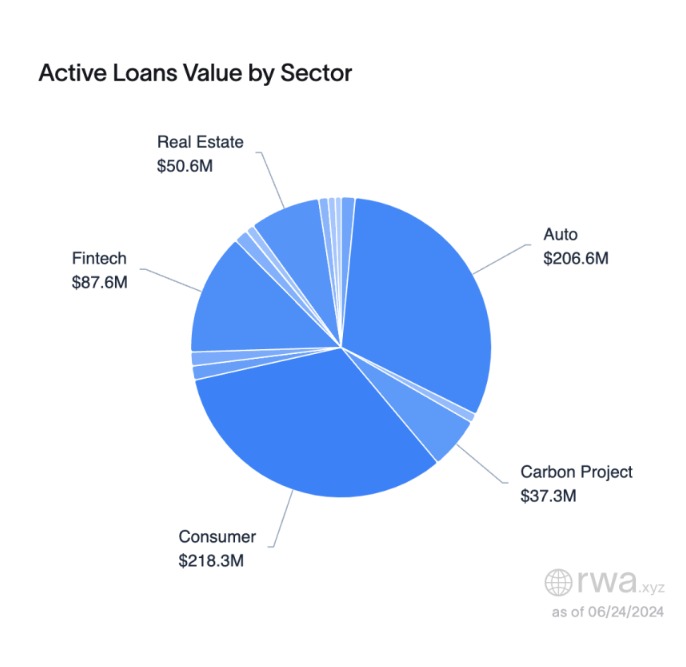

Sectoral Distribution of Loan Values in Leading Protocols According to RWA.xyz

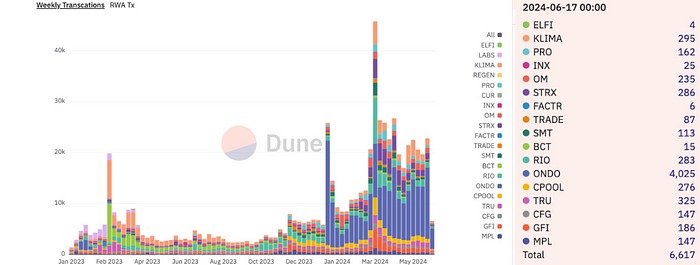

Weekly RWA Transaction Numbers (Source)

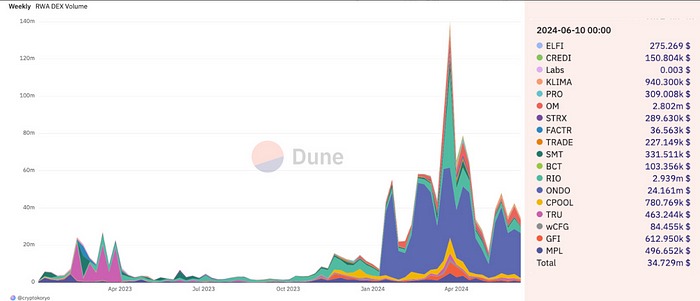

Distribution by RWA Sub-Categories According to DEX Volumes (Source)

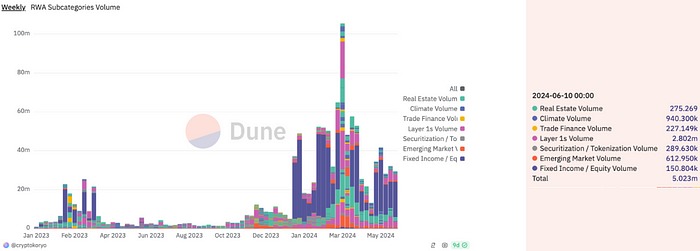

Volume Distribution by RWA Sub-Categories (Source)

⚖️ Legal and Regulatory Frameworks

Tokenization and Regulations in the Stablecoin World. Recent reports indicate that stablecoins play a significant role in the world of tokenization, with tokenization of real-world assets like U.S. Treasury Bills (T-bills) garnering interest. However, regulatory uncertainties and low demand are hindering the progress of some tokenization projects. Additionally, new regulations proposed by the Basel Committee aim to help banks manage their exposure risks to stablecoins. Source

Circle’s USDC Stablecoin to Benefit from EU Regulatory Changes. Kaiko states that Circle’s USDC stablecoin will benefit from the new regulations of the European Union. Source

🖇️ Institutional Investments and Strategic Partnerships

Mina Foundation has established a strategic partnership with Mirae Asset Financial Group, South Korea’s largest financial group. The partnership will integrate Mina Foundation’s secure, lightweight, and efficient blockchain infrastructure with Mirae Asset’s extensive financial services portfolio. Source

Japanese retail giant Marui issued digital green bonds through the Securitize platform in May. The bond, worth 170 million yen (1.1 million dollars), will be used for purchasing a renewable energy plant. Bondholders will be paid 1% interest, EPOS points, and cash. Source

Deutsche Bank joins Project Guardian managed by the Monetary Authority of Singapore (MAS) aiming to manage tokenize assets using blockchain technology. This pilot project seeks to bring new revenue models and operational changes in the field of asset tokenization and digital finance. Source

SEC Discussions on USDC and IPO Between Circle and Coinbase. The SEC is reviewing Circle’s planned initial public offering (IPO) and the regulatory status of the stablecoin USDC. Circle aims to expand the use of USDC in collaboration with Coinbase in line with its IPO plans. Source

🏠 Asset Tokenization

Tether announces the launch of a new digital asset, Alloy by Tether, supported by Tether Gold (XAU₮). Alloy uses over-collateralization with liquid assets and secondary market liquidity pools to maintain unit value. Source

McKinsey predicts that tokenized real-world assets (RWA) will reach $2 trillion by 2030. This figure indicates that widespread adoption is still far off. The company notes that digital assets are transitioning from early adoption to mass adoption, but challenges such as legal regulations and infrastructure deficiencies need to be overcome. Source

BrickMark Group Completes Series A Funding of 10 Million CHF Led by Dynasty Global. Through this strategic partnership, BrickMark will integrate Dynasty’s D¥N payment token into its real estate tokenization platform. This agreement will enable BrickMark to tokenize its real estate assets valued at 1.5 billion CHF. Source

Tokenization of real-world assets (RWA) performed at 58% in May. Significant developments include Galaxy Digital’s loan backed by a Stradivarius violin and the digital share sale of Watford FC. Additionally, regulatory discussions took place in the U.S. Financial Services Committee. These developments highlight the potential for broader acceptance of tokenization in financial markets. Source.

🪙 Tokenization of Financial Products & Stablecoins

FalconX launches trading support for USTB (U.S. Treasury Bonds) collateralized trades, aligning with the trend of tokenizing U.S. Treasury securities. This enhances the liquidity of tokenized U.S. government bonds, reaching a broader investor base. The platform has made USTB trading support available as of June. Source

France’s first AMF-licensed tokenized money market fund provider, Spiko, raised €4 million in pre-seed funding. Spiko offers tokenized money market funds using Ethereum and Polygon blockchain technologies. The company has set a minimum investment amount of $1000/€1000 for retail investors, and the fund shares are compatible with Web3 wallets. Source

The value of tokenized U.S. Treasury products has increased by 1,000% this year, reaching $1.29 billion. Two major players in this field are Franklin Templeton’s on-chain government security fund and BlackRock’s BUIDL fund. BUIDL leads with a market value of $462 million, while Franklin Templeton’s fund is valued at $344 million. Source

Abrdn’s Russell Barlow characterizes tokenization as more transformative than artificial intelligence, noting that it is built on crypto infrastructure. However, he emphasizes that high-profile asset tokenization and regulatory cooperation are necessary for this technology’s adoption. Source

🏦 Central Bank Digital Currencies (CBDC) & Banking

The Bank of Thailand opens its regulatory sandbox to test programmable payment systems based on distributed ledger technology (DLT). This system will be used to execute payments under specific conditions, provide escrow services, and facilitate asset tokenization. The test program will accept applications for three months. Source

The European Central Bank (ECB) and the Bank of England will experiment with the interoperability of foreign exchange (FX) transactions between real-time gross settlement systems (RTGS) and DLT-based systems. This initiative aims to reduce liquidity requirements and mitigate daily risks in the $2.2 trillion FX market. The project will run alongside the ECB’s wholesale digital central bank currency (CBDC) trials and conclude at the end of 2024. Source

Swiss National Bank and SDX Developments. The Swiss National Bank (SNB) and SIX Digital Exchange (SDX) are conducting in-depth work on central bank digital currencies (CBDC) and tokenized securities. This pilot project aims to use tokenized Swiss francs for digital asset exchanges among financial institutions. SNB reports that with the completion of this project, they are technically ready to go live. CoinDesk

💻 Infrastructure and Technology Developments

BVNK integrates Swift payments into its platform, offering fast and efficient global transactions between USD, EUR, and stablecoins. This integration provides significant flexibility and cost benefits for payment service providers, fintechs, and foreign exchange trading platforms. BVNK now supports a broad payment infrastructure with 14 digital currencies and stablecoins and 15 fiat currencies. Source

Stablecoin issuer Circle has increased its workforce by over 15% this year and aims to fill a similar number of positions ahead of its public listing. This expansion is seen as part of the company’s strategy to strengthen its operational capacity and solidify its position in the growing stablecoin market. Source: BNN Bloomberg

Citi introduces its new integrated digital asset platform, CIDAP, at the Digital Currency Symposium. This platform aims to support all of the bank’s digital currency and tokenization projects. CIDAP supports both Ethereum and other blockchain networks, providing technological independence. Source

🔏 Insurance

The World’s First Tokenized Life Insurance Policy. Infineo has created the world’s first tokenized life insurance policy on the Provenance Blockchain. This innovation allows for easier digital management and transfer of insurance policies. Infineo’s initiative highlights the potential of blockchain technology in the life insurance sector. Source

Featured Content:

EU Failed Stablecoin Regulations Could Disrupt the Market

The European Union’s Markets in Crypto-Assets (MiCA) regulations, set to take effect on June 30, pose a risk of fragmenting the $155 billion stablecoin market. MiCA requires issuers to be based within the EU and hold reserves in local banks, which poses challenges for dollar-based stablecoin issuers. Additionally, it mandates that major stablecoins keep 60% of their reserves in banks.

DL NEWS: Opinion: Why EU stablecoin rules threaten to upend crypto markets — By Hugo Coelho, Mike Ringer

Digital Assets Gaining Interest Among Investors

A 2024 study by EY-Parthenon shows increased interest from institutional investors in digital assets. Out of 277 participants, 94% believe in the long-term value of digital assets and blockchain technology. Source