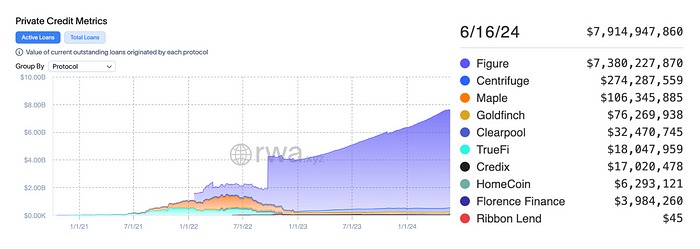

Distribution of Loan Values in Pioneer Protocols According to RWA.xyz

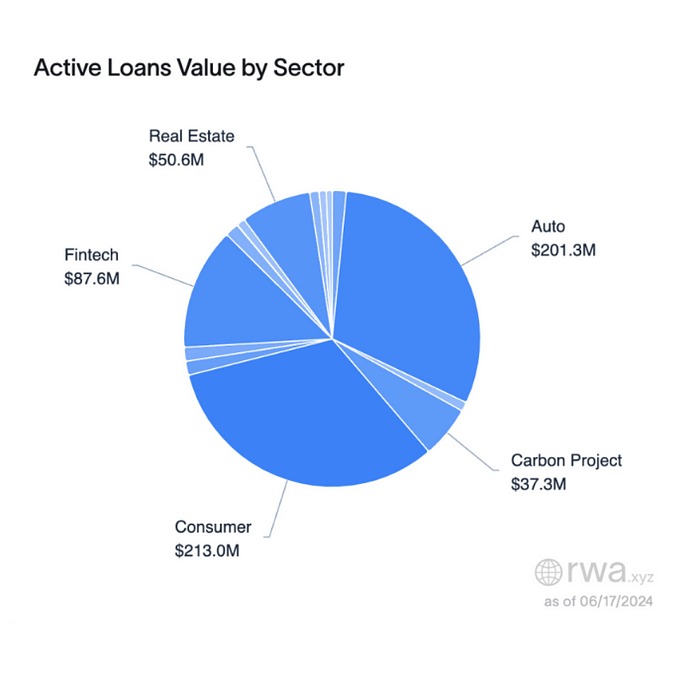

Distribution of Loan Values in Pioneer Protocols by Sector According to RWA.xyz

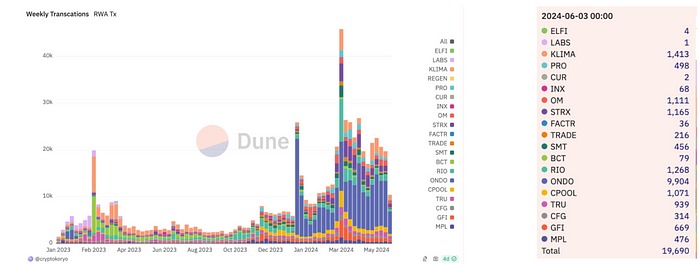

Weekly RWA Transaction Number (Source)

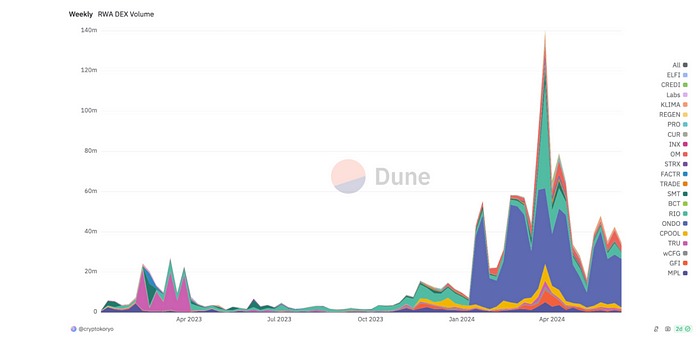

Distribution by DEX Volumes in RWA Subcategories (Source)

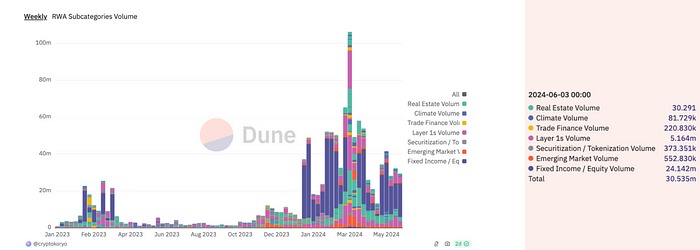

Volume Distribution by RWA Subcategories (Source)

⚖️ Legal and Regulatory Frameworks

DTCC, Euroclear, and Clearstream have come together to set tokenization standards. In a newly published report, these companies have established principles for the safe and reliable tokenization of digital assets. This step aims to facilitate the adoption of blockchain technology by banks and asset managers. The report states that blockchain technology could accelerate financial services and reduce costs. Currently, only 37% of the finance sector is using blockchain technology. Source

MiCA Regulations Encouraging the Rise of Euro-Backed Stablecoins. The EU’s Markets in Crypto-Assets (MiCA) regulations aim to create an alternative to USD-backed stablecoins by promoting the use of Euro-backed stablecoins. These regulations are intended to make Europe more independent and competitive in digital finance while strengthening the Euro’s role in the digital economy. Source

Confusion Over Public Blockchains and Securities. A session in the US Congress on the tokenization of real-world assets (RWAs) highlighted the uncertainties and confusions regarding public blockchains and securities. Experts provided differing views on how public blockchains should be used for RWA tokenization and how they should be regulated. Source

High Likelihood of Passing the Stablecoin Bill Before Elections in the US. JPMorgan noted that this bill, which will regulate the stablecoin market, will also enhance the market’s growth and security. The law will require firms issuing stablecoins to undergo strict audits and transparent financial reporting. Source

The session in the US Congress on the tokenization of real-world assets (RWAs) showed confusion regarding public blockchains and securities. During the session, disagreements arose among representatives and experts on how assets tokenized on public blockchains should be regulated. This situation underscores the need for a clear and consistent regulatory framework for RWA tokenization. Source

President Biden vetoed the decision to cancel SAB 121, which continues to restrict banks’ ability to offer digital asset custody services. SAB 121 makes the custody of crypto assets excessively costly. With this veto, Biden aimed to protect the SEC’s authority over accounting practices. However, banks and some senators argue that this endangers consumer safety and that banks are more experienced in custody services. Source

🖇️ Institutional Investments and Strategic Partnerships

Multicoin Capital and Coinbase Ventures invested in the Latin America-based stablecoin super app El Dorado. This investment aims to increase access to financial services in the region and support economic stability. El Dorado emerges as a platform that facilitates users’ daily financial transactions. Source

Brickken Selected to Join the European Blockchain Regulatory Sandbox. This initiative will allow Brickken to test and develop its tokenization solutions within Europe’s regulatory framework. The sandbox is supported by the European Commission and is designed to promote regulatory compliance for blockchain technologies. Source

🏠 Asset Tokenization

Galaxy Digital tokenized a rare violin to support a loan as collateral. This innovative financing method provides liquidity by transforming physical assets into digital assets. This tokenization allows assets like valuable artworks and rare musical instruments to be used as collateral on the blockchain, thus providing broader financial access. Source

While the tokenization of special assets offers promises of increased liquidity and expanding investment opportunities, it also carries dangers such as regulatory uncertainties and technological risks. Tokenization makes illiquid assets like real estate, artwork, and private equity more accessible while posing significant challenges in terms of investor protection and security. Source

Ripple announced that it will offer tokenized gold on the XRP Ledger in 2024. This innovation will allow XRP Ledger users to buy, sell, and transact with gold as a digital asset. Source

Tokenization of Music Catalogs. The music industry is undergoing a profound transformation with innovations brought by Web3 technologies. This new model allows fans to invest directly in their favorite artists and share in the revenues from music works. Source

🪙 Tokenization of Financial Products & Stable Tokens

Bitcoin Suisse issued a tokenized bond on the Polygon network. This step strengthens the integration of traditional finance with blockchain technology, offering investors more flexible and accessible investment opportunities. Tokenized bonds aim to increase the transparency and speed of transactions while also reducing costs. Source

Franklin Templeton has taken a new step that allows investors to purchase funds using stablecoins. The company aims to increase the impact of stablecoins on financial markets, while also being aware of the competition brought by offshore tokenization. Source

Fidelity International tokenized a money market fund on JPMorgan’s blockchain. This move provides investors with faster and more efficient access to funds, demonstrating the integration of traditional financial products with blockchain technology. Source

The total market value of tokenized treasury bonds reached $1.44 billion in 2024, an increase of 100.27% from the previous year, with BlackRock’s BUIDL being the largest tokenized treasury product at a market value of $462 million. This tokenization provides investors with broader access and faster, secure transactions on the blockchain. A hearing will be held by the US Congress to discuss the tokenization of real-world assets. Source

Oxbridge Re reported successful returns from tokenized reinsurance securities. Source

Franklin Templeton CEO Praises Public Blockchain. Franklin Templeton CEO Jenny Johnson highlighted the importance of the firm’s tokenized money market fund operating on a public blockchain. Johnson emphasized that the blockchain provides significant cost savings by serving as a source of general ledger and accuracy. Additionally, Franklin Templeton’s fund offers instant yield payments on the Stellar blockchain, allowing investors to earn intra-day returns. Source

Today, BlackRock’s USD Corporate Digital Liquidity Fund (BUIDL) paid a monthly dividend of $1.7 million to investors on the Ethereum blockchain. Source Tweet.

Umar Farooq, CEO of JP Morgan’s blockchain division Onyx, was promoted to co-head of payment systems. This change follows JP Morgan’s daily average payment volumes reaching $9.7 trillion and generating $18.2 billion in revenue in 2023. Farooq noted that JPM Coin reached billions of dollars in volume on some days. Onyx continues to promote JPM Coin as a payment solution for other distributed ledgers. Source

Aptos Labs CEO Mo Shaikh appointed to the CFTC’s Digital Assets Subcommittee. This committee advises the CFTC on regulations affecting international trade and business. Aptos, using the Move programming language originated from Diem (Facebook’s blockchain project), offers a blockchain network capable of fast transactions. Aptos Labs raised $400 million from investors like Andreessen Horowitz and Jump Crypto, with a valuation over $4 billion. Source

🏦 Central Bank Digital Currencies

(CBDC) & Banking The World Federation of Exchanges (WFE) stated that the main benefit of tokenization is “fractionalization.” Fractionalization allows investors to invest in high-value assets like real estate and artworks with small shares, providing access to a broader investor base and increasing market liquidity and accessibility. Source

BIS’s Agora Project for Banking Tokenization. The International Payments Bank (BIS) introduced the Agora Project in collaboration with seven central banks, aiming to transform cross-border payments through tokenization. The project plans to conduct payments using wholesale central bank digital currencies (wCBDC) and tokenized deposits on a shared infrastructure. Source

Circle applied to join the Agora Project managed by the International Payments Bank (BIS). Their goal is to revolutionize cross-border payments using the power of digital currencies and blockchain technology. Circle aims to collaborate with public and private financial institutions to replace existing systems with a faster, scalable, and cost-effective global financial system. Source

The Central Bank of the Philippines (BSP) approved the pilot implementation of the country’s first stablecoin, PHPC. This stablecoin aims to address remittance issues faced by Filipinos abroad and provide clarity in cryptocurrency regulations. PHPC is pegged at a 1:1 ratio to the Philippine peso and was developed by Coins.ph. In 2023, Filipinos sent $33.49 billion in remittances, and PHPC aims to reduce the rejection rates in remittance transactions. Source

Paxos launched a new yield-generating stablecoin in the United Arab Emirates. This stablecoin aims to provide both stability and regular returns to investors. Paxos CEO Charles Cascarilla stated that this innovation could attract more institutional investors to the digital assets market. The new stablecoin is backed by the US dollar and designed to comply with regulations. Source

Saudi Arabia joined the mBridge cross-border digital central bank currency (CBDC) project, which also includes China, the United Arab Emirates, and Thailand. The project has moved to the minimum viable product (MVP) stage, aiming to facilitate faster, secure, and cost-effective cross-border payments. This initiative is seen as an important step in enhancing international trade and financial cooperation. Source

Russia will start using digital central bank currency (CBDC) for cross-border payments in 2025. This initiative aims to make Russia’s international trade transactions faster, more secure, and efficient. Source

The European Central Bank is Focusing on Privacy in the Digital Euro Design. The digital euro will allow users to make small payments without revealing their identities, while stricter identity verification procedures will be applied for large transactions. However, some critics remain skeptical about how secure government-backed digital currencies will be in terms of privacy and anonymity. Source

💻 Infrastructure and Technology Developments / Investments

Unitas Protocol aims to offer stablecoins for emerging market currencies, allowing small and medium-sized businesses to make payments in their local currencies. These stablecoins are over-collateralized by US dollar stablecoins. Source

Tether invested $18.75 million in Taiwan-based XREX for cross-border B2B stablecoin payments. XREX holds various licenses and offers financial solutions, particularly for emerging markets. They will also issue gold-backed stablecoins through the Unitas Protocol. Source

Multicoin Capital and Coinbase Ventures invested in the Latin American stablecoin-based super app El Dorado. El Dorado aims to facilitate daily financial transactions and increase access to financial services for a broader user base. Source

The cryptocurrency-focused financial technology firm M⁰ raised $35 million to develop a decentralized stablecoin issuance network. Leading institutions such as insurance giant Swiss Re and FinTech investment firm Polychain Capital participated in the funding round. Source

Mountain Protocol successfully completed an $8 million Series A funding round for its stablecoin, USDM. Leading investment firms such as Multicoin Capital, Castle Island Ventures, Coinbase Ventures, Bankless Ventures, Dept of XYZ, Borderless Capital, and Aptos participated in the round. Mountain Protocol’s USDM is regulated and yield-generating, holding a prudential license from the Bermuda Monetary Authority. Source

Mantra’s OM token gained value due to the growing interest in the tokenization of real-world assets. The company facilitates easier access for investors to assets such as real estate, artworks, and other physical assets by tokenizing them on the blockchain. Source

Clearpool launched credit vaults, expanding to the Avalanche network. This step further enhances Clearpool’s decentralized lending ecosystem, facilitating the participation of lenders and borrowers in liquidity pools and credit provision. Source

ODX CEO stated that public blockchains are necessary for Japan’s secondary securities token market. The CEO emphasized the critical importance of the transparency, security, and accessibility advantages of public blockchains for secondary market transactions. Source

Solana is developing the ecosystem for the tokenization of real-world assets (RWA) on the blockchain, aiming to tokenize a wider range and diversity of assets. Source

Ledgible launched a new service providing tax solutions for tokenized real assets. Source

🧐 Featured Readings:

https://www.cryptotimes.io/2024/06/06/blockchain-too-slow-for-tokenization-financial-professor/ — Blockchain Too Slow for Tokenization: Financial Professor Hilary Allen

https://www.bankless.com/how-should-we-sell-eth-to-tradfi?ref=bankless.ghost.io — How to Sell ETH to Wall Street

https://www.coinbase.com/tr/blog/the-state-of-crypto-the-fortune-500-moving-onchain — The State of Crypto: The Fortune 500 Moving Onchain”