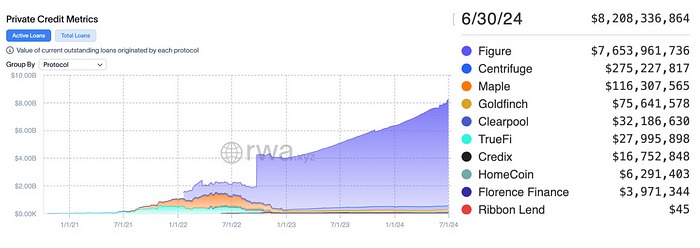

Distribution of Loan Values in Leading Protocols According to RWA.xyz

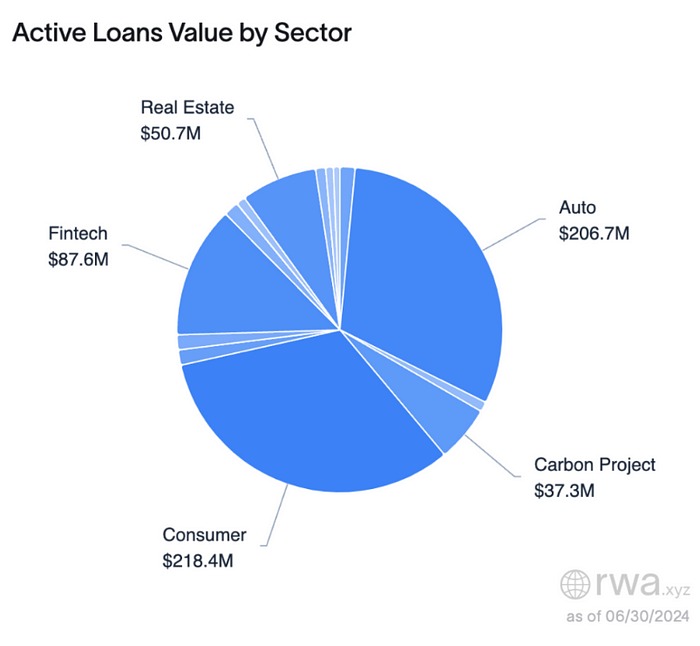

Distribution of Loan Values by Sector in Leading Protocols According to RWA.xyz

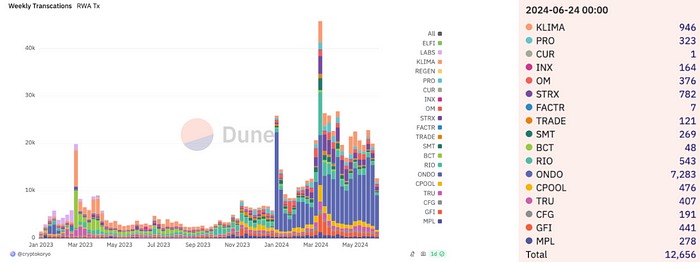

Weekly RWA Transaction Numbers (Source)

Distribution by RWA Subcategories According to DEX Volumes (Source)

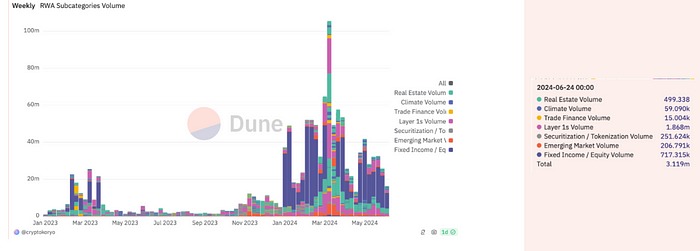

Volume Distribution by RWA Subcategories (Source)

⚖️ Legal and Regulatory Frameworks

EU’s Strict Stablecoin Rules. The EU’s restrictive stablecoin regulations will soon take effect, and issuers are racing against time. Source

Bitstamp Removes Euro Tether (EURT) from Its List Due to MiCA Compliance. Source

🖇️ Institutional Investments and Strategic Partnerships

BitGo, Arbelos Markets, Nonco, and Superstate Establish a New Standard for Tripartite Digital Asset Transactions. Source

Rakkar and DigiFT Partnership: Rakkar and DigiFT form a strategic partnership to advance regulated real-world assets in the digital finance space. Source

Investcorp and Securitize Partner to Tokenize Funds. This partnership will facilitate the presentation and management of investment funds as digital assets. Source

Raze Finance and Texture Capital Partnership. Raze Finance aims to increase liquidity for tokenized real-world assets through its partnership with Texture Capital. Source

🏠 Asset Tokenization

With the implementation of the EU’s Markets in Crypto Assets (MiCA) regulations, Swarm Markets has launched a new service that allows users to purchase tokenized gold through NFTs. This platform is designed to digitize real-world assets and reach a broader investor base. Swarm Markets stated that the tokens will comply with the EU’s know your customer rules and anti-money laundering regulations. Source

Standard Chartered Predicts Tokenization Market to Reach $30.1 Trillion by 2034. Trade finance will play a significant role in this growth. Source

🪙 Tokenization of Financial Products & Stablecoins

Asset management firm abrdn states that the tokenization of financial assets holds significant transformative potential for the financial services industry in terms of accessibility and liquidity. However, regulatory uncertainties and compatibility issues with existing market infrastructure are highlighted as major barriers to tokenization. abrdn continues to explore the opportunities offered by blockchain technology while emphasizing the need to overcome these challenges in the industry. Source

A survey in Japan reveals that 54% of institutional investors plan to invest in digital assets within the next three years. 62% of the participants view digital assets as a diversification opportunity, and 25% have a positive outlook on crypto assets. Most participants consider crypto assets as an investment asset class, planning to allocate 2–5% of their investments to digital assets. Source

Ripple Plans to Launch a New Stablecoin Service. Source

UDPN Launches Production Systems for Tokenized Deposits, Stablecoins, and Asset Tokenization. This aims to expand access to digital financial services. Source

Stablecoin Issuers Become the 18th Largest Holder of US Debt. Source

In ECB’s DLT Experiments, Boerse Stuttgart and Germany’s Largest Banks to Collaborate on Tokenized Securities Settlement. Source

USDZ: RWA-Backed Stablecoin. Source

🏦 Central Bank Digital Currencies (CBDC) & Banking

The Kansas City Federal Reserve Publishes Research on the Costs and Potential Effects of Stablecoin Insurance. The study suggests that insurance could play a significant role in making stablecoin markets safer and more stable. However, it notes that insurance costs could increase operational costs for issuers, which might ultimately be passed on to the user. Source

The Swiss National Bank (SNB) and Switzerland’s SIX Exchange Successfully Complete Digital Franc and Tokenized Bond Pilot Project. This trial was conducted to demonstrate how digital assets could be integrated into financial markets. The project proved the efficiency and security of the digital franc and tokenized bonds, paving the way for future digital financial infrastructure projects. Source

Transaction Volumes for India’s Retail CBDC Decline. Consumer transactions with India’s digital rupee have dropped to about 100,000 daily, down from a million a day last year. The Reserve Bank of India (RBI) had offered incentives last year to reach one million daily retail CBDC transactions. Source

BRICS Increases Cross-Border CBDC Supporters with Thailand’s Application. Thailand has applied for BRICS membership and joined the mBridge cross-border CBDC project. Thailand, along with China, UAE, Saudi Arabia, and Hong Kong, aims to promote trade using local currencies in this project. Source

The Swiss National Bank (SNB) Announces Extension of Digital Franc Pilot Program for At Least Two More Years. This extension aims to test and evaluate the integration processes of the digital franc more comprehensively. Source

Banque de France Shares Use of Wholesale CBDC for EIB Digital Bond Payment. This pilot project aims to increase speed and efficiency in financial transactions. Source

MAS Expands. The Monetary Authority of Singapore (MAS) extends industry collaboration to scale asset tokenization for financial services. Source

💻 Infrastructure and Technology Developments

Arbitrum Foundation’s Committee Recommends Investment in Six Real-World Asset Products, Including BlackRock’s BUIDL Fund. These recommendations are part of Arbitrum’s strategy to support projects that contribute to the development of its blockchain ecosystem. BlackRock’s BUIDL Fund focuses on accelerating the adoption of digital assets and blockchain technology through investment in next-generation infrastructure projects. Source

Stablecoin Issuer Tether Halts USDT Minting on EOS and Algorand Blockchains. Tether states that this decision is due to a decline in user demand and changes in market dynamics. Editor’s note: This is quite negative news for Algorand. Native (directly provided by Tether on that network) USDT is considered an important measure of liquidity and usage on blockchain networks. Source

Fintech Company Revolut Starts Offering Bond Trading Service to Individual Investors Across Europe. This new service allows users easy access to various bonds and diversifies their portfolios. Source

MakerDAO’s Investment Manager Monetalis Remains in Position Despite 59% Against Votes in Dismissal Poll. The firm presented delayed reports and planned an audit for July. Monetalis will transfer its reporting responsibilities to AccountAble. Source

Andromeda Completes Integration with Injective Blockchain to Accelerate DeFi Adoption. This integration will support the widespread adoption of decentralized finance applications. Source

Ondo Finance and DriftProtocol: Ondo Finance announces a $2 million USDY deposit into DriftProtocol following an integration that allows USDY to be used as collateral. Source

Mountain Protocol Announces Addition of BlackRock’s BUIDL Fund Tokenized by Securitize to Its USDM Reserves. Source

Deutsche Bank-Backed Taurus Expands Digital Asset Custody and Issuance Services to Stellar Network. Source

🔎 Featured Readings:

Tokenization: From $16 Trillion to $2 Trillion

Despite decreasing interest, the potential and future applications of tokenization are discussed.

Author: Harvey — Crypto Adoption Curve — Source

Most Profitable Crypto Sectors in the First Half of 2024

Among the most profitable crypto sectors in the first half of 2024 were decentralized finance (DeFi), decentralized exchanges (DEX), and NFT markets.

Particularly, DeFi achieved significant gains with the rapid growth of new products and user base.

Decentralized exchanges saw an increase in trading volumes, while NFT markets garnered significant interest in art and collectible products.

Author: VINCE QUILL — Cointelegraph — Source

Reducing Risks of Tokenized Assets

Highlights: Robust regulatory frameworks, transparency, audits to prevent market manipulation, and secure technical infrastructure are crucial for mitigating the risks of tokenized assets.

Author: Axel Jester — Coindesk — Source

The Era of Mass Adoption for Digital Assets

Market Situation: Bitcoin’s significant rise in 2024 demonstrates the permanence of cryptocurrencies.

Usability Issues: The daily use of digital assets remains fraught with challenges.

Development and Integration: Blockchain projects are working to improve speed, security, and user experience.

New Standards: New token standards like ERC1400 are being developed to meet regulatory requirements.

Future Potential: Interest in digital assets is expected to increase in 2024, with these technologies becoming safer and more user-friendly.

Potential of Layer-1 Blockchains

Layer-1 blockchains are making financial systems more secure, transparent, and efficient.