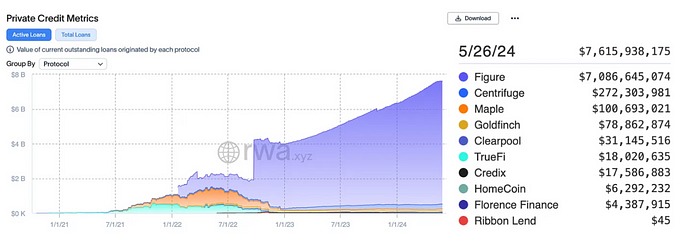

Distribution of Loan Values in Leading Protocols According to RWA.xyz

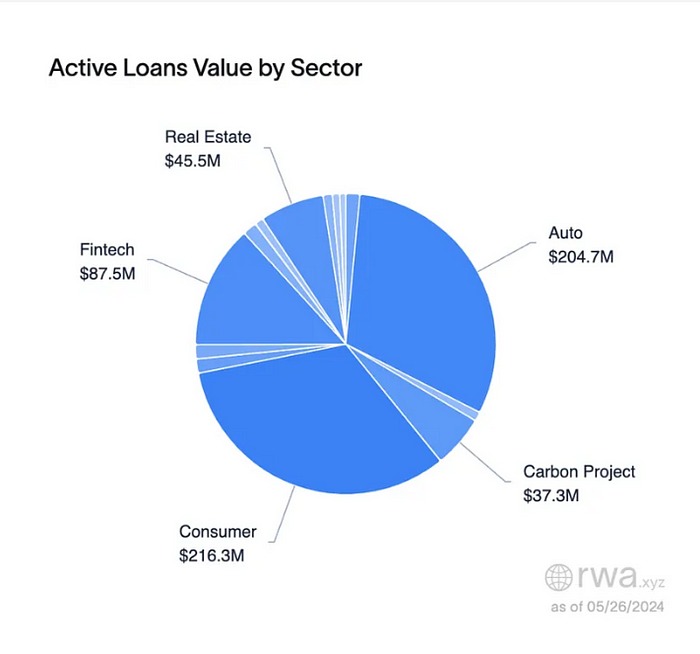

Distribution of Loan Values in Leading Protocols by Sector According to RWA.xyz:

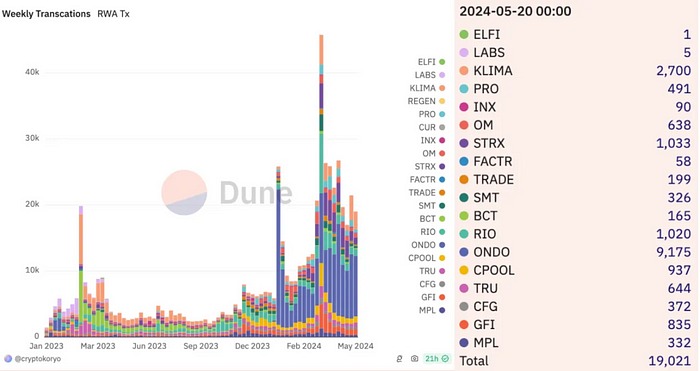

Weekly RWA Transaction Count (Source)

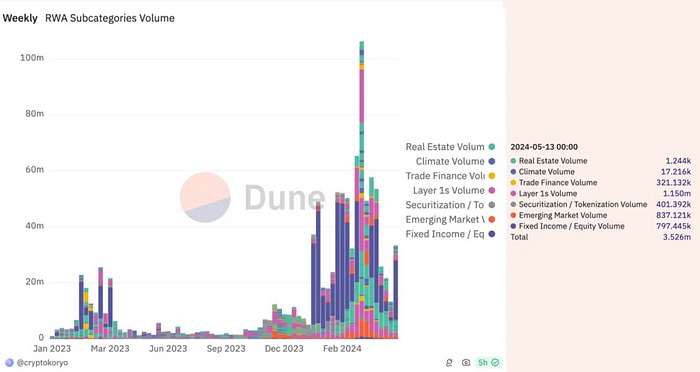

Volume Distribution by RWA Subcategories (Source)

⚖️ Legal and Regulatory

Frameworks SEC Approves Ether ETFs, Recognizes Ether as a Commodity.

The U.S. Securities and Exchange Commission (SEC) has officially recognized Ether as a commodity by approving Ether (ETH) based exchange-traded funds (ETFs). This approval allows investors to directly invest in Ether, making crypto assets part of mainstream financial products. The SEC’s decision is seen as a significant step in regulating crypto markets and increasing institutional investors’ access to crypto assets. Source

With the spread of ETFs (Exchange Traded Funds) in the crypto world, Solana’s involvement in this field is also on the agenda. The launch of new ETFs will provide investors with easier and safer access to Solana and other crypto assets. This move aims to expand Solana’s investor base and bring more liquidity to crypto markets. Source

Standard Chartered announced that it is expanding its ETF and token services for cryptocurrencies. This expansion aims to provide institutional and individual investors with easier access to crypto assets. By developing digital asset services, the bank aims to cater to a broader investor base in crypto markets and contribute to the digital transformation of financial markets. Source

🖇️ Institutional Investments and Strategic Partnerships Maple Finance Collaborates with Figment for Institutional-Grade Solana and Ethereum Staking Operations.

Maple Finance has partnered with blockchain infrastructure provider Figment to offer institutional-grade staking services for Solana and Ethereum. This collaboration aims to provide secure and efficient staking solutions to institutional investors. Maple Finance aims to attract more institutional investors by enhancing the security and efficiency of staking operations through this partnership. Source

Arta TechFin and Chainlink Labs Expand Digital Asset Collaboration and Form Strategic Partnership for Blockchain-Based Solutions.

This strategic partnership aims to enhance security and transparency in the digital asset ecosystem. Under the partnership, Chainlink’s decentralized oracle networks will be integrated with Arta TechFin’s digital asset platform to provide more secure and efficient blockchain solutions. Source

Nomura’s Digital Asset Arm Laser Digital Supports Kelp DAO and RWA Project MANTRA.

This support aims to expand MANTRA’s blockchain-based solutions, making real-world assets more accessible through digitization. Nomura’s move aims to promote innovation in financial services and establish a strong presence in the digital asset ecosystem. Source

🏠 Asset Tokenization Coinbase Derivatives Adds Oil and Gold to Futures Portfolio.

Coinbase announced that it has expanded its derivatives product portfolio by adding oil and gold futures. Coinbase’s move aims to appeal to a broader investor base in the crypto derivatives market. Source

“Diamonds as Digital Currency: How This Innovation Can Revolutionize Payments.” Diamonds can be tokenized to be used as digital currency, creating a new revolution in payment systems. This innovation aims to add a new layer of trust and liquidity to financial transactions by allowing diamonds to be used as a store of value and medium of exchange. Digital diamond currencies, trading securely and transparently thanks to blockchain technology, can offer an alternative to traditional currencies. Source

🪙 Tokenization of Financial Products & Stable Tokens

Mastercard Conducts First Tokenized Deposit Transactions with Subsidiaries of Standard Chartered. This transaction aims to test a new financial infrastructure that enables the secure and efficient management of digital assets. Tokenized deposits are created by converting traditional bank deposits into digital tokens, and this technology aims to increase the speed and security of financial transactions. Source

“Ripple’s Stablecoin Launch: A Game-Changing Move.” Ripple took a significant step in the crypto ecosystem by launching its stablecoin. This stablecoin, claiming to maintain its value stable, is designed to be used in digital payments and cross-border transactions. Ripple’s move highlights its proximity to the traditional financial sector. Source

Digital Bonds Will Become Mainstream! Digital bonds are rapidly becoming mainstream in the traditional bond market. Thanks to evolving blockchain technology, digital bonds are issued and managed more transparently, securely, and cost-effectively. This development is seen as a significant milestone in the digitalization of financial markets, allowing investors to conduct faster and more efficient transactions. Source

🏦 Central Bank Digital Currencies (CBDC)

Banking Tokenization and CBDCs Included in CPMI Work Program. The Committee on Payments and Market Infrastructures (CPMI) expanded its new work program to include tokenization and central bank digital currencies (CBDCs). This program aims to encourage the adoption of digital financial technologies to enhance the security and efficiency of global payment systems. CPMI aims to develop regulatory and operational frameworks by researching how tokenization and CBDCs can be used in financial markets. Source

Digital Yuan Pilot Project in Hong Kong: Testing Peer-to-Peer Transactions. Hong Kong launched a pilot project for peer-to-peer (P2P) transactions using digital yuan (e-CNY). The digital yuan pilot program in Hong Kong currently only allows cross-border transactions and does not permit P2P transfers. Source

Colombia’s Largest Bank Bancolombia Announces Offering Stablecoin and Crypto Services. This service aims to expand customers’ financial access by providing opportunities to conduct transactions and investments through digital assets. Source

Brazil’s Central Bank Plans to Draft Stablecoin and Crypto Regulations This Year. Brazil’s Central Bank aims to develop a plan this year to create a regulatory framework for stablecoins and cryptocurrencies. This initiative responds to the need for the growth of digital financial systems and better oversight of this area. The bank’s strategic agenda also includes innovations related to the integration of fintech and digital payment systems. Source

“Potential Regulations in Stablecoin Laws Raise Concerns in the Banking Sector.” Regulations may lead to stricter oversight of companies issuing stablecoins and decrease banks’ competitiveness in this area. The growing market share of stablecoins and their increasing use in financial transactions could challenge banks’ traditional business models. Source

mBridge Participants China and Thailand Sign Local Currency Agreement. Under the mBridge project, China and Thailand signed an agreement to facilitate cross-border central bank digital currency (CBDC) transactions using local currencies. This agreement aims to increase the use of local currencies in trade and financial transactions, reducing the impact of exchange rate fluctuations. The mBridge platform provides a blockchain-based infrastructure to make cross-border transactions faster, cheaper, and more secure. Source

🌿 Carbon Credits / Tokenization

MUFG, One of Japan’s Largest Financial Groups, Collaborates with KlimaDAO to Explore Stablecoin Payments for Tokenized Carbon Credits. This collaboration aims to make the trade of carbon credits more efficient and secure. Using stablecoins will increase the transparency and traceability of transactions with the digitization of carbon credits. Source

💻 Infrastructure and Technology Developments

re.al Launches First Modular RWA L2 and Returns 100% of Its Revenue to Users. re.al launched the first modular RWA L2 (Layer 2) platform supported by Arbitrum Orbit. This platform commits to returning 100% of its revenue to users. re.al demonstrates an innovative approach in blockchain-based financial services by allowing users to manage their assets more securely, quickly, and cost-effectively. Source

Plume Receives $10 Million Seed Investment from Haun Ventures and Galaxy Digital for Its Layer 2 Blockchain Platform Tokenizing Real World Assets (RWA). With this investment, Plume aims to digitize physical assets and make them more accessible. The platform aims to expand the use of blockchain technology in financial and commercial transactions by increasing transaction speed and cost efficiency. Source