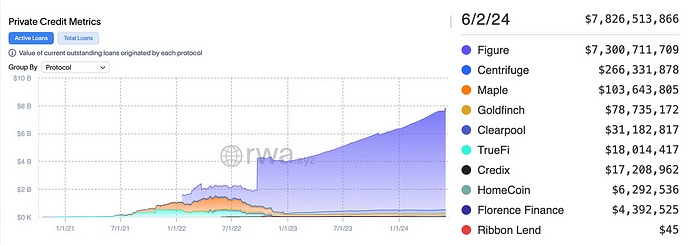

Distribution of Loan Values in Leading Protocols According to RWA.xyz

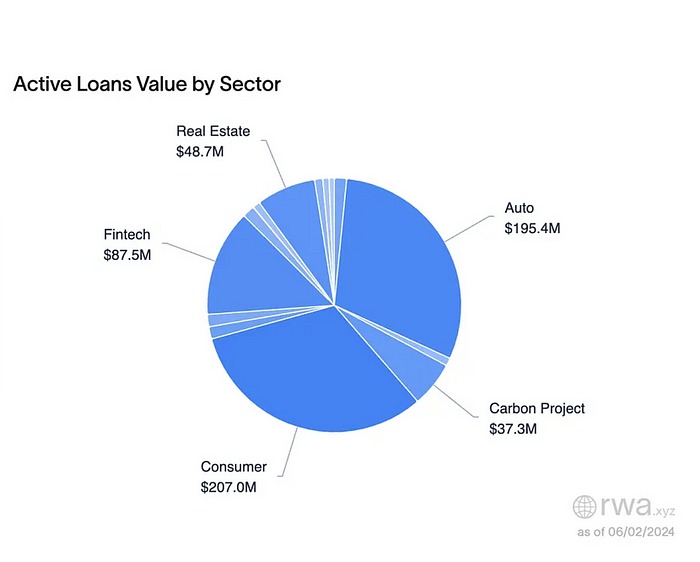

Distribution of Loan Values in Leading Protocols by Sector According to RWA.xyz

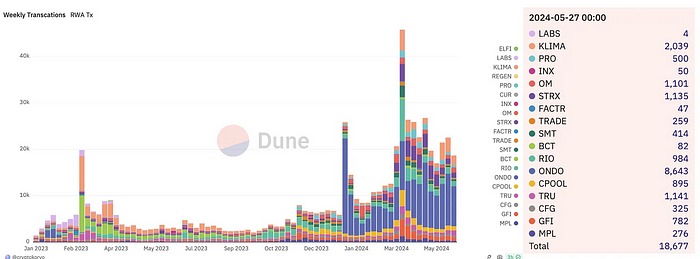

Weekly RWA Transaction Count (Source)

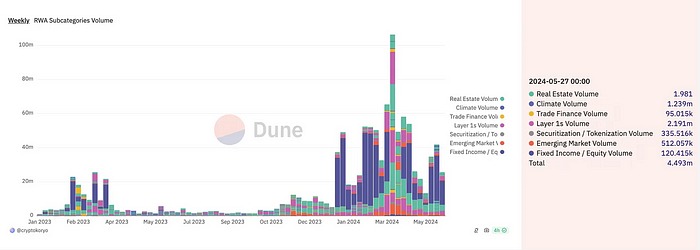

Volume Distribution by RWA Subcategories (Source)

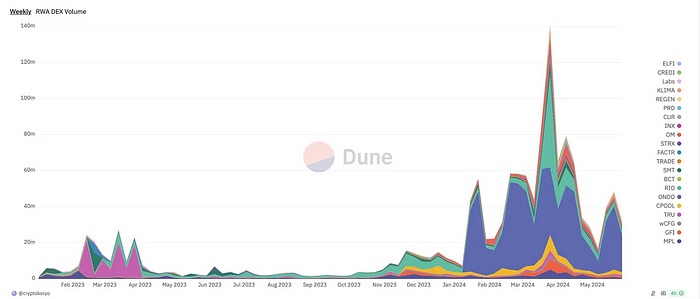

Volume Distribution by DEX in RWA Subcategories (Source)

⚖️ Legal and Regulatory Frameworks

PayPal Receives New York Crypto Trust Charter: PayPal has received a Crypto Trust Charter from the New York State Department of Financial Services (NYDFS), allowing it to offer crypto services in New York. With this charter, PayPal can offer its cryptocurrency, PayPal USD (PYUSD), to a broader user base and support more cryptocurrencies. Source

SEC Commissioner Proposes “Safe Harbor” Experiment for Digital Securities: This experimental space aims to exempt innovative blockchain projects and digital assets from current regulatory frameworks for a certain period to encourage innovation. Source

🖇️ Institutional Investments and Strategic Partnerships

Gnosis Pay Partners with Visa to Connect Web3 Ecosystems with Traditional Payments: This collaboration will allow digital assets and cryptocurrencies to be integrated with traditional payment infrastructure, enabling users to use their crypto assets in everyday shopping. This partnership aims to increase the adoption and use of Web3 technologies among a broader audience. Source

Plume Receives $10 Million Seed Investment for RWA-Focused Layer-2 Project: This fund will be used to develop and expand Plume’s blockchain infrastructure. The project aims to contribute significantly to the digital asset ecosystem by enabling the more efficient and secure digitization of real-world assets. Source

Anzen Finance Receives $4 Million Seed Investment: Anzen Finance plans to use this fund to develop and expand its stablecoin projects. The company aims to offer innovative solutions in the digital asset market by providing stablecoins based on real-world assets. Source

Mastercard Begins First Peer-to-Peer Pilot Transactions with Crypto Credential, Adds New Partners to Ecosystem: This platform aims to increase the security and transparency of crypto transactions. Additionally, Mastercard plans to expand its crypto payment solutions by adding new partners to its ecosystem. Source

HSBC Leads Series A Investment Round for Marketnode’s DLT Market Infrastructure: This investment will allow Marketnode to develop and expand its DLT solutions. Marketnode aims to provide more efficiency and security in financial markets by focusing on the tokenization and digitization of securities. Source

🏠 Asset Tokenization

Blocksquare Reaches $100 Million in Tokenized Real Estate and Introduces DeFi Launchpad: This platform will allow real estate owners to tokenize their assets and enable investors to buy and sell these tokens through DeFi protocols. The DeFi Launchpad aims to make real estate investments more liquid and accessible to a broader investor base. Source

Polymesh Tokenizes $30 Million in Real Estate Assets: This initiative aims to represent real estate ownership as digital tokens, allowing investors easier access and investment in these assets. The tokenization process aims to increase the liquidity of real estate investments and reach a broader investor base. Source

SteelWave Launches $500 Million Real Estate Fund with Digital Tokens: This fund will allow investors to buy and sell real estate assets through digital tokens. SteelWave aims to make real estate investments more accessible and liquid with this innovative approach. Source

🪙 Tokenization of Financial Products & Stable Tokens

PayPal Integrates Its Stablecoin PYUSD into the Solana Blockchain: This move aims to expand PayPal’s digital payment systems, offering faster and lower-cost transactions. Solana’s high transaction speeds and low costs can increase the adoption and use of PYUSD. Source

Credit Unions in the US Begin Adopting Tokenization of Real-World Assets (RWA): This step aims to improve liquidity management and offer more diversified investment opportunities to their investors. Through tokenization, credit unions can represent assets like ownership documents as digital tokens, providing more secure and efficient asset management. Source

Maple Finance Launches New Institutional Yield Program Called Syrup: This program aims to offer institutional investors safe and high-yield investment opportunities in the DeFi (decentralized finance) space. Syrup will provide returns to investors in different asset classes through liquidity pools, aiming to increase the flow of institutional capital into the DeFi ecosystem. Source

Centrifuge Brings Real-World Assets (RWA) to DeFi: This platform will allow asset owners to tokenize real-world assets like real estate, commercial loans, and invoices and use these tokens as collateral in DeFi protocols. This innovation aims to increase the liquidity of the DeFi market and include a broader range of assets in the digital finance world. Source

Fortunafi Receives Investment for Tokenization and Stablecoin Protocol Reservoir: This investment will enable Fortunafi to develop its tokenization projects and stablecoin protocol. Reservoir stands out as a protocol aiming to increase stability and security in the tokenization process. Source

Helix Introduces Helix 2.0, the New Version of Its DeFi Platform: This update integrates the tokenization of real-world assets (RWA) and advanced trading features into the platform. Helix 2.0 is designed to enable users to tokenize and trade real-world assets more securely and efficiently. Source

🏦 Central Bank Digital Currencies (CBDC) & Banking

USDC Issuer Circle Enters Brazilian Market, Partners with Leading Bank BTG Pactual and Digital Banking Giant Nubank: These strategic partnerships aim to increase the adoption of USDC and expand access to digital financial services in Brazil. The use of USDC in Brazil can make financial transactions faster and lower-cost. Source

Nomura’s Digital Asset Arm Laser Digital Partners with Japan-Based GMO for Stablecoin Issuance: This partnership aims to explore the possibilities and potential uses of stablecoin issuance in Japan. The partnership aims to accelerate the adoption of stablecoins, especially in financial services and payments. Source

Israel Launches Digital Shekel CBDC Competition: The Bank of Israel aims to focus on the design and feasibility of the digital shekel by organizing this competition for innovative solutions. The competition invites fintech firms and academic institutions to explore the potential uses of the digital shekel. Source

South Korea’s Woori Bank and NH Nonghyup Bank Develop Tokenization Platforms: Both banks are working to support the tokenization of real-world assets and encourage innovations in this area. Source

Triple-A Aims to Double Payment Volume Using PayPal’s Stablecoin: This strategic move will allow Triple-A to offer faster and lower-cost transactions by integrating PYUSD into its payment infrastructure. PayPal’s stablecoin will contribute to the wider adoption of cryptocurrency in everyday use. Source

India’s Wholesale CBDC Pilot Project Shows Low Numbers: The project aims to facilitate large-scale transactions between financial institutions, but so far, participation and transaction volumes have been limited. The pilot’s low numbers indicate potential challenges in the adoption and effective implementation of wholesale CBDC. Source

💻 Infrastructure and Technology Developments

JPM Coin Transactions Experience High Demand Due to Programmability Feature: This feature allows JPM Coin to be used more efficiently and flexibly in various financial transactions and automated payment systems. Source

Featured Readings:

- BIS CPMI 2024 Work Program: Security and Innovation in Financial Markets: The Bank for International Settlements (BIS) Committee on Payments and Market Infrastructures (CPMI) announced its 2024 work program. This program includes a series of initiatives to enhance the security of financial markets, promote digital innovations, and strengthen the resilience of global payment systems. The work will particularly focus on areas such as digital assets, decentralized finance (DeFi), and central bank digital currencies (CBDC). Link

- US House Digital Assets Subcommittee to Discuss Tokenization of Real-World Assets: Link

- PwC’s RWA Tokenization Program: A Look into a Tokenized Future: Link

- Garlinghouse: Fixing Ripple’s Stablecoin at $1 Easier Than USDC: Link