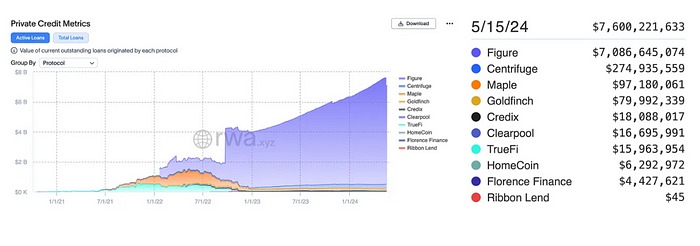

Distribution of Loan Values in Pioneer Protocols According to RWA.xyz

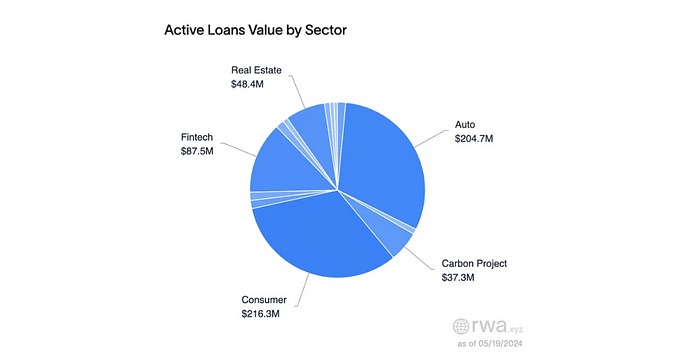

Distribution of Loan Values in Pioneer Protocols by Sector According to RWA.xyz

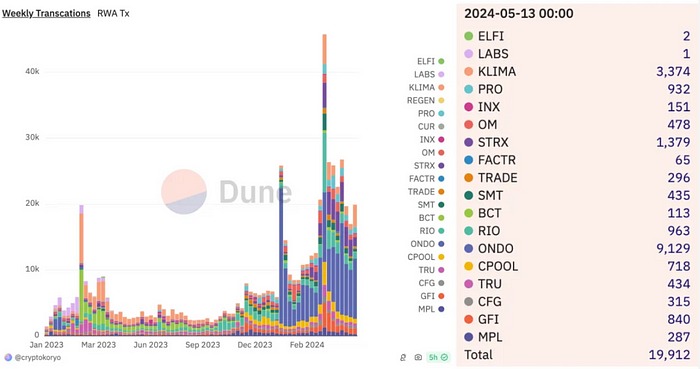

Dune.io Weekly RWA Transactions

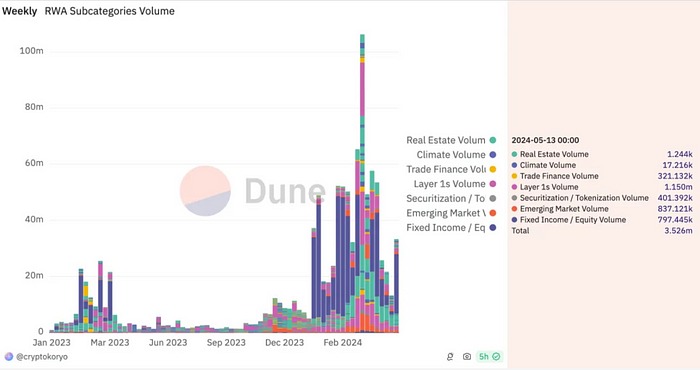

Volume Distribution by Subcategories in Dune.io RWA

Basel Crypto Rules Postponed to 2026. The Basel Committee has postponed the implementation of banking rules related to crypto assets to 2026. The committee broadly defines crypto assets, covering cryptocurrencies, stablecoins, and tokenized securities. The postponement was made to allow all members to apply the standards fully and consistently. Plans are also in place to revise some rules and tighten risk classifications. Source

Circle Plans to Move Legal Center to the US. USDC stablecoin issuer Circle is applying to move its legal center from Ireland to the US ahead of its IPO plans. This move aims to align the company more closely with the regulatory environment in the US and facilitate the IPO process. The company has submitted a confidential S-1 document to the SEC. Source

US Senate Votes to Repeal SEC’s Crypto Accounting Policy. The US Senate voted to repeal the SEC’s crypto accounting policy, SAB 121, which imposed strict rules on how crypto assets should be accounted for. The vote was supported by 48 Republicans and 12 Democrats. President Joe Biden plans to veto this decision, which could further intensify the debates on this policy. Source

🖇️ Institutional Investments and Strategic Partnerships

Tether Continues to Expand in Eastern Europe with CityPay. Tether is increasing its investment in CityPay.io, a Georgia-based payment service, to continue its expansion in Eastern Europe. Following successful results from the initial collaboration, Tether is making a second investment. Source

Glasstower Plans to Use Tokenized Money Market Funds for Cross-Border Payments. Glasstower Digital plans to use tokenized money market funds for B2B cross-border payments. This approach provides real-time transaction and settlement in corporate payments, overcoming the challenges of traditional payment systems. Target customers include multinational companies, international charities, and global financial institutions. Source

🪙 Tokenization of Financial Products

Franklin Templeton: ETFs and Investment Funds to Move to Blockchain. Jenny Johnson, CEO of Franklin Templeton, predicts that all ETFs and investment funds will move to blockchain technology. Franklin Templeton’s blockchain-based money market fund has a market value of $367 million and more than 400 token holders. Johnson emphasizes that blockchain reduces transaction costs and enhances efficiency. Source

JPMorgan Onyx to Industrialize Blockchain PoCs from Project Guardian. JPMorgan’s blockchain platform Onyx focuses on industrializing Proof of Concepts (PoCs) developed under Project Guardian. The project aims to scale investment fund tokenization and blockchain-based financial products. Companies like WisdomTree are planning to offer personalized portfolios and various financial services on-chain during this process. Source

Tokenized Funds Could Impact the Stablecoin Market. Colin Butler, head of corporate capital at Polygon, mentions that tokenized financial products could play a significant role in the stablecoin market. Companies like Franklin Templeton and BlackRock are notable for their tokenized funds. Butler predicts that these products may not offer the yields provided by stablecoins but can narrow the stablecoin market by adapting to specific use cases. Source

RWA Platform Re Launches Tokenized Reinsurance Fund on Avalanche. The RWA (Real World Assets) platform has relaunched a tokenized reinsurance fund on Avalanche. Initial investors include Nexus Mutual, which has committed $15 million. This initiative aims to adopt blockchain technology through the tokenization of traditional reinsurance funds. Source

🏦 Central Bank Digital Currencies (CBDC) & Banking

Philippines Approves Peso-Linked Stablecoin Pilot. The Central Bank of the Philippines has approved a pilot program for a peso-linked stablecoin to enhance digital financial inclusion in the country. This program will test the effectiveness and potential benefits of the stablecoin. The Philippines aims to be a leader in the adoption of digital currencies in Asia. Source

Nigeria’s Experience with Stablecoin Adoption and Challenges. The adoption of stablecoins is rapidly increasing in Nigeria, but this process faces challenges such as regulatory uncertainties, low liquidity, and infrastructure deficiencies. While stablecoins offer benefits like protection against inflation and facilitation of cross-border transactions, overcoming these challenges is essential for enhancing financial inclusion in Nigeria. Source

Applications for Central Bank Tokenization Project Agorá Close in 2 Weeks. BIS, in collaboration with seven central banks, has launched applications for private sector participants in Project Agorá. The project explores the use of tokenized deposits and central bank money for cross-border payments. Applications will close on May 31, and results will be announced in early August. Source

World Bank to Issue First International CHF Digital Bond. The World Bank will issue its first international digital bond denominated in Swiss francs (CHF). This bond, worth 200 million CHF ($220 million), will be payable with the Swiss franc wholesale central bank digital currency (wCBDC) provided by the Swiss National Bank (SNB). The bond, which matures on June 11 and expires in 2031, covers a seven-year period. Source

Hong Kong Expands Integration of China’s eCNY CBDC. The Hong Kong Monetary Authority (HKMA) is expanding the integration of China’s eCNY digital currency. Hong Kong residents can now top up eCNY wallets through the Fast Payment System (FPS). This step aims to enhance the wider acceptance of eCNY and increase its use in retail payments in Hong Kong. Source.

📰 Other News

Glasstower Plans to Use Tokenized Money Market Funds for Cross-Border Payments. Glasstower Digital plans to use tokenized money market funds for B2B cross-border payments. This approach provides real-time transaction and settlement in corporate payments, overcoming the challenges of traditional payment systems. Target customers include multinational companies, international charities, and global financial institutions. Source.

MakerDAO Founder Announces Launch of Fully Decentralized PureDai. The founder of MakerDAO has announced that a fully decentralized new stablecoin, PureDai, will be launched in a few years. This new stablecoin is seen as an innovative step in the decentralized finance (DeFi) space and will represent a more decentralized version of the existing Dai stablecoin. Source

Synthetix sUSD Depreciates. Synthetix’s sUSD stablecoin temporarily lost its 1:1 USD linkage. This situation caused fluctuations in the value of the stablecoin and raised concerns among users. sUSD, built on Ethereum and widely used in various financial applications, especially in trading and lending transactions, is a commonly used stablecoin. Source

Peaq Positions as a Layer 1 Solution for RWA, Raises $20 Million with CoinList Launch. Peaq, a Layer1 blockchain suitable for DePIN and machine RWA applications, raised $20 million through a native token launch on CoinList. The launch, which took place between May 9–16, has so far generated demand exceeding $36 million from more than 145,000 community members. The newly raised funds will be used to accelerate the growth of the Peaq ecosystem and strengthen various ecosystem and community plans.

💻 Infrastructure and Technology Developments

JPM Coin to Be Used on Broadridge DLT Repo Platform. JPMorgan’s Onyx platform will enable the use of JPM Coin for settlement on Broadridge’s Distributed Ledger Repo (DLR) platform. This integration synchronizes blockchain networks, providing delivery versus payment for intraday repo transactions. The use of JPM Coin outside of the Onyx blockchain marks an expansion of digital asset platforms for cash solutions. Source

🔍 Featured Readings

A Lawyer’s Perspective on What the Cryptocurrency Law Bill Means?https://x.com/Ahmet_btc/status/1791748823582167156

AI & Crypto, Balaji’s Thread:

https://twitter.com/balajis/status/1790491120373281213

Comparison by Maple Finance: Maple Direct Secured Lending vs. Aave v3

https://maple.finance/news/comparison-maple-direct-secured-lending-vs-aave-v3

https://www.bloomberg.com/news/videos/2024-05-16/connecting-real-world-to-any-blockchain-video"