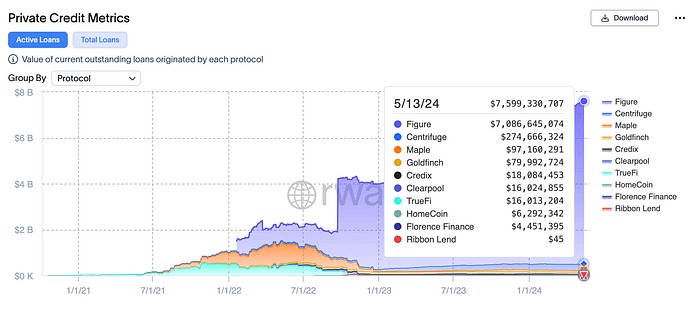

Distribution of Loan Values in Leading Protocols According to RWA.xyz

Note: rwa.xyz integrated Figure this week.

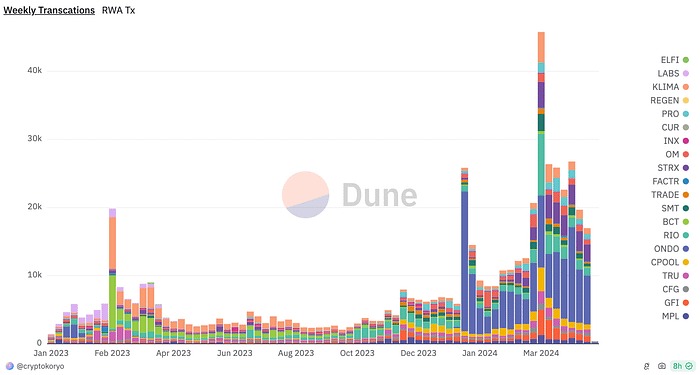

Dune.io RWA Transactions:

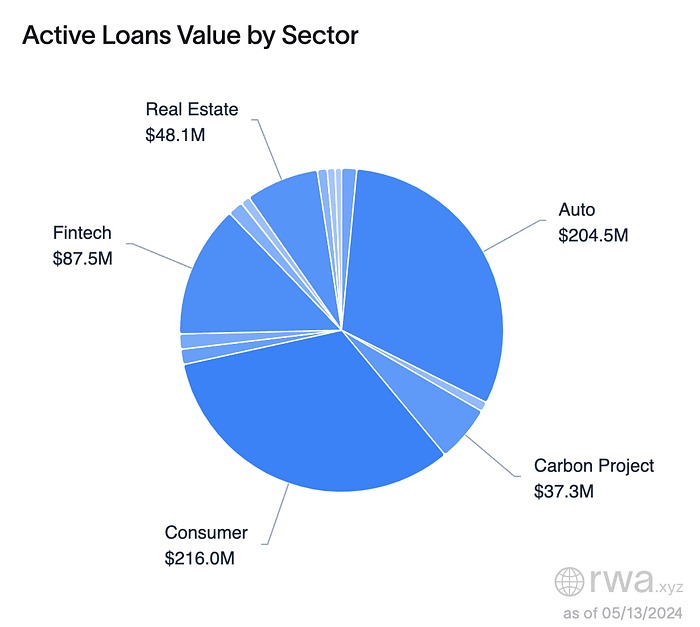

Sector-wise Distribution of Loan Values in Leading Protocols According to RWA.xyz:

⚖️ Legal and Regulatory Frameworks

Reaction from the US House of Representatives to the SEC

The US House of Representatives passed a bipartisan resolution to repeal the SEC’s directive SAB 121, which restricts crypto asset custody services. If repealed, the SEC would not be able to issue similar directives. The White House has stated that the president will veto this resolution because it could limit the SEC’s future actions regarding crypto assets. Source.

🏠 Asset Tokenization

AgriDex on Solana Network Receives Investment

AgriDex, a platform designed to tokenize agricultural products on the Solana blockchain, recently completed a $5 million pre-seed funding round, raising its market value to approximately $19 million. AgriDex plans to launch its own token, AGRI, within the year. Source.

Tokenization Firm BlockInvest Receives Investment

BlockInvest, a tokenization firm that includes Crédit Agricole Italia among its supporters, received a strategic investment from Italian venture capital firm Open Venture. This investment will help BlockInvest strengthen its leadership position in the European market, where it develops digital mini bonds for small and medium-sized enterprises and runs tokenization projects for asset-backed securities (ABS). Source.

🖇️ Institutional Investments and Strategic Partnerships

Citadel-backed EDXM Global Launches Settlement Platform in Singapore

Citadel-backed EDXM Global has launched a Settlement platform in Singapore, starting initially with OTC transactions. It also aims to acquire a trading license in Singapore and host derivative transactions. Source.

Jefferies-backed Tradu Retail Set to Launch Crypto Exchange

Tradu, a subsidiary of Stratos and wholly owned by Jefferies, began offering cryptocurrency trading aiming to compete with low commission fees. Tradu charges only 0.1% per transaction, a rate comparable to Binance and significantly lower than other competitors like Coinbase. Source.

🏦 Central Bank Digital Currencies (CBDC) & Banking

Citi and JP Morgan Join SIFMA-Coordinated US DLT Settlement Trials

Citi, JP Morgan, and other major financial institutions are participating in a distributed ledger trial called the Regulated Settlement Network (RSN), which includes tokenized deposits and US Treasury bonds. This project aims to make USD transactions more secure and efficient, exploring the potential of using blockchain technology in financial markets. Source.

Deutsche Bank: Stablecoins Will Fail

According to a study by Deutsche Bank analysts, most stablecoins are likely to fail. The study indicates that stablecoins have low chances of success due to their lack of credibility, unsupported reserves, and non-regulation in tightly controlled systems. Source.

Colombia’s Largest Bank Launches Crypto Exchange and Peso Stablecoin Wenia

Bancolombia announced the launch of its cryptocurrency exchange and peso stablecoin, Wenia. The platform aims to attract 60,000 users in its first year and compete with rivals like Binance and Bitso. Source.

Philippines’ First Peso-Backed Retail Stablecoin to Be Launched in June

Coins.ph, a digital asset exchange in the Philippines, received approval from Bangko Sentral ng Pilipinas to launch a local stablecoin, PHPC. PHPC will be pegged to the Philippine peso, offering users a secure and stable store of value while potentially reducing costs and increasing transaction speeds in remittances and trade. Source.

🪙 Tokenization of Financial Products

JP Morgan Prefers Private Blockchains Over Public Ones for Large Transactions

JP Morgan has expressed a preference for a private ledger called the Unified Ledger for major transactions, which enables trusted transactions among financial institutions. Dante Disparte from Circle highlighted the financial system’s shortcomings, such as not operating on weekends and nights, suggesting that this slowness is marketed as a financial speed strategy. Source.

RD Technologies Launches HKDR Stablecoin Pegged to Hong Kong Dollar with Chainlink Integration

RD Technologies, founded by former Hong Kong Monetary Authority Chief Norman Chan, plans to launch a stablecoin pegged to the Hong Kong dollar, HKDR. This stablecoin will be integrated with Chainlink’s Cross-Chain Interlink Protocol, enabling secure transactions across various blockchain platforms and will be supported by verified reserves through Chainlink’s Reserve Proof. Source.

Liv Digital Bank Signs Agreement for RWA Tokenization

Liv Digital Bank signed an agreement with Ctrl Alt to tokenize real-world assets, focusing particularly on the interest of Generations Y and Z in alternative assets. This deal makes Liv a pioneer in digital innovations, becoming the first bank in the UAE to offer these new investment opportunities to its customers. Source.

Dinari Introduces “Complaint DEX” Product.

Dinari announced its DEX product. Source.

Tokenized Money: The Next Major Innovation After Fiat

William Quigley, co-founder of Tether, argued that tokenizing fiat currencies is the next major innovation after fiat money, predicting that it will open new mechanisms in global finance in the coming years. Quigley believes that global economies will likely transition to tokenized money within the next decade, and one day, tokenized fiat or stablecoins like USDT could even offer interest or returns in exchange for holding digital assets. Source.

Insurance and Web3

Nayms, an innovative digital insurance marketplace, announced a collaboration with Coinbase to provide seamless insurance transactions for insurance companies, reinsurance funds, and capital providers. Source.

📰 Other News

Chairman of the Senate Banking Committee, Sherrod Brown (D-Ohio), expressed willingness to merge stablecoin regulations with legislation that facilitates financial services for the cannabis industry.

US Senator Brown Seeks Protection for Consumers from Risks of Using Stablecoins

Tether Responds to Deutsche Bank’s Report Claiming Stablecoins Are Unsafe

Deutsche Bank recently published a report suggesting that stablecoins like Tether (USDT) could fail and potentially lead to a major crash in the cryptocurrency market. Tether strongly criticized the report, claiming that the bank’s allegations were “lacking solid evidence” and “based on vague claims rather than rigorous analysis.” Moreover, Tether questioned the authority of Deutsche Bank to criticize any financial institution given its own history. Source.

Onyx Opens to Third-Party Developers.

JP Morgan’s blockchain initiative Onyx has processed over $1 trillion in transactions to date and conducts daily transactions worth $2 billion. At the Tokenize This conference, the company announced that it would open the Onyx Digital Assets platform to third-party applications. Source.

🔍 Featured Readings

The Stablecoin Debate That Isn’t, Zero Hedge

The Future of Stablecoins: New Forms of Money Revolutionizing the Digital Economy https://www.zerohedge.com/markets/stablecoin-debate-isnt

What Does Real-World Asset Tokenization Mean for Asset Managers, Morning Star

Why DeFi lending?

https://www.bis.org/publ/work1183.pdf

The Future of Tokenization? Permissioned Blockchains

According to this article discussing the advantages and disadvantages of public and permissioned blockchains, institutions are more likely to use permissioned blockchains for tokenization in the near future due to their enhanced control, privacy, and compliance. However, public blockchains, being more transparent and efficient, may be more suitable for tokenization in the long run.

https://blockworks.co/news/future-tokenization-permissioned-blockchains

🛋️ Article of the Week: CoinDesk Consensus Magazine:

BlackRock, Ondo, Superstate: The Biggest Movers in the RWA Sector in Q1 The Rise of Tokenized Real World Assets: Major Institutional Investments and Market Growth

Major Institutional Participation: Major financial institutions like BlackRock, Superstate, and Ondo are playing an active role in the RWA market by investing in tokenized Treasury bonds and other RWAs.

Market Growth: The RWA market grew by 41% in the last quarter, reaching a volume of nearly $1.3 billion.

New Product Launches: BlackRock raised $280 million, Superstate raised $82 million; this indicates rapid market acceptance of new tokenized products.

Technological Integration and Innovations: The integration of RWAs with DeFi protocols offers the potential for 24/7 programmable settlements and frictionless transactions.

Infrastructure Development: Efforts to develop infrastructure supporting RWAs are increasing, accelerating technological advancements and integration in the sector.

https://www.coindesk.com/consensus-magazine/2024/05/07/blackrock-ondo-superstate-the-biggest-movers-in-the-rwa-sector-in-q1/